Elon Musk's Controversial Role at DOGE: Implications for Investors

AI-generated based on this event

TL;DR

Elon Musk's leadership at the Department of Government Efficiency (DOGE) faces legal challenges from labor unions over access to sensitive data. This development could impact various sectors, including IT services and automotive, with potential shifts in competitive dynamics and public sector employment.

Introduction

In this analysis, we delve into the recent legal and regulatory developments surrounding Elon Musk's appointment as head of the Department of Government Efficiency (DOGE). Investors will gain insights into the potential impacts on key sectors, including IT services and automotive, as well as the broader implications for public sector employment and international aid.

Background

The controversy began with Elon Musk's appointment by former President Donald Trump to lead the newly established Department of Government Efficiency. This role has sparked legal challenges from labor unions, particularly the AFL-CIO, concerned about Musk's access to sensitive government data. A federal judge's decision to allow Musk's department access to the U.S. Department of Labor's systems marks a significant moment in this unfolding saga. The unions argue that Musk's influence could lead to the dismantling of critical government agencies and mass layoffs, raising alarms among lawmakers and advocacy groups.

Scenarios Analysis

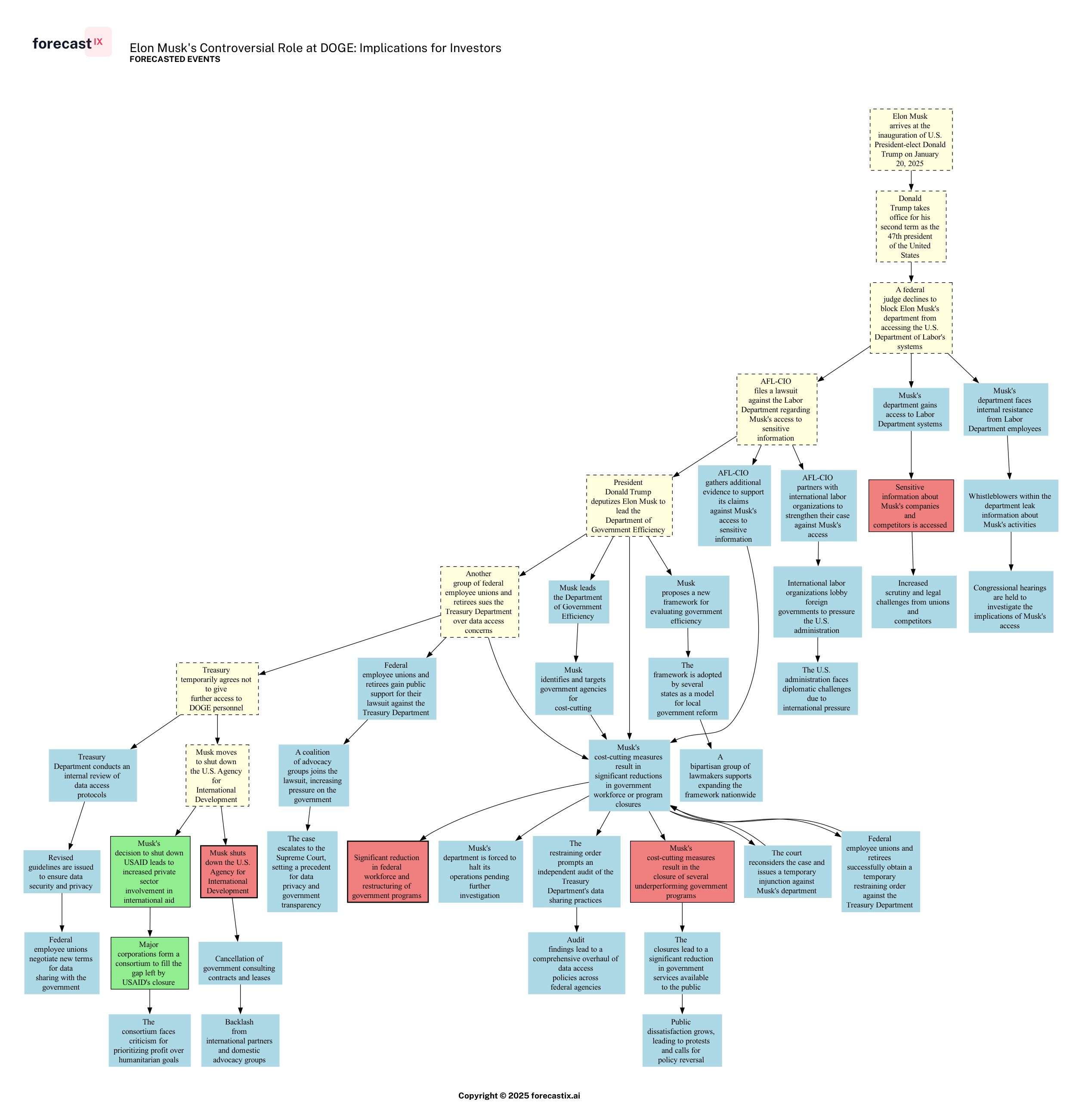

Forecasted chain of events following the Root Events from the base article (yellow). AI-generated.

Forecasted chain of events following the Root Events from the base article (yellow). AI-generated.

In the unfolding drama surrounding Elon Musk's controversial role as the head of the Department of Government Efficiency, several intriguing scenarios emerge, painting a picture of a tumultuous future for federal governance and labor relations.

Internal Resistance and Whistleblowing

One of the most compelling narratives is the potential for Musk's department to face internal resistance from Labor Department employees. This scenario could lead to whistleblowers leaking information about Musk's activities, sparking Congressional hearings to investigate the implications of his access to sensitive data. Such developments could significantly impact Musk's ability to implement his efficiency-driven reforms, as increased scrutiny might slow down or even halt his initiatives. The potential for whistleblowers to step forward highlights the tension between Musk's cost-cutting measures and the ethical considerations of data privacy and security.

Legal Challenges by Labor Unions

Another fascinating scenario involves the AFL-CIO's persistent efforts to gather additional evidence against Musk's access to sensitive information. If successful, this could lead to the court reconsidering the case and issuing a temporary injunction against Musk's department. This legal maneuvering could force a halt in operations, pending further investigation, and might even prompt a comprehensive overhaul of data access policies across federal agencies. Such a scenario underscores the power of organized labor and advocacy groups in challenging government decisions and protecting workers' rights.

International Aid and Private Sector Involvement

On the international stage, Musk's decision to shut down the U.S. Agency for International Development (USAID) could lead to increased private sector involvement in international aid. While major corporations might form a consortium to fill the gap left by USAID's closure, they could face criticism for prioritizing profit over humanitarian goals. This shift from public to private sector-led aid efforts could redefine the landscape of international development, raising questions about the role of profit-driven entities in addressing global challenges.

Public Backlash and Workforce Reductions

Lastly, the potential for Musk's cost-cutting measures to result in significant reductions in government workforce or program closures presents a scenario fraught with public dissatisfaction. The closure of underperforming government programs could lead to a significant reduction in services available to the public, sparking protests and calls for policy reversal. This public backlash could serve as a powerful reminder of the delicate balance between efficiency and the social contract that government services represent.

These scenarios, while speculative, offer a glimpse into the complex interplay of power, policy, and public perception in the evolving narrative of Musk's leadership at the Department of Government Efficiency. As events unfold, the outcomes of these scenarios will undoubtedly shape the future of federal governance and labor relations in the United States.

Impact Analysis

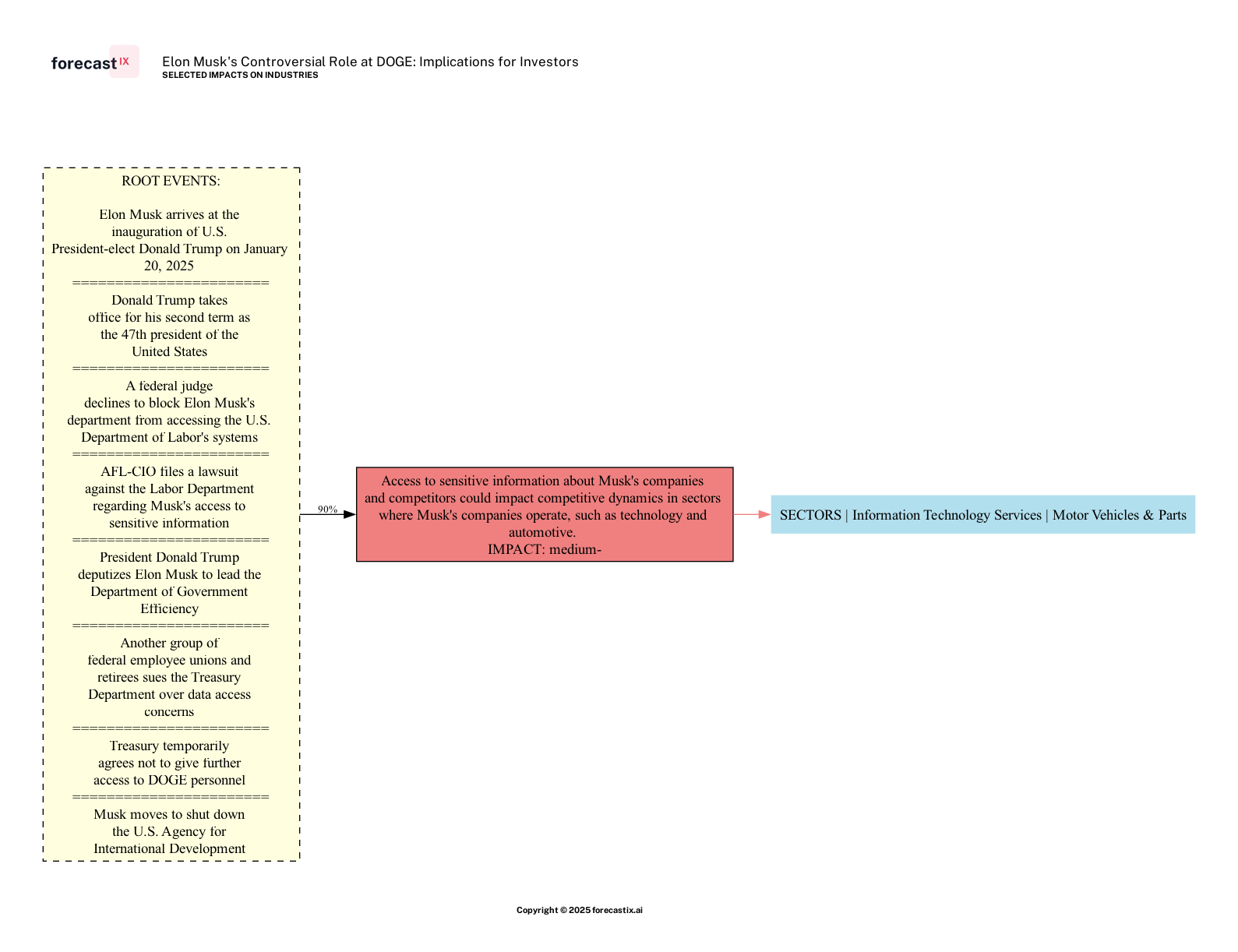

Selected forecasted impacts on industries. Note various likelihood, strength, and direction. AI-generated.

Selected forecasted impacts on industries. Note various likelihood, strength, and direction. AI-generated.

The unfolding drama surrounding Elon Musk's leadership of the Department of Government Efficiency (DOGE) is poised to send ripples through various sectors, with some potentially seismic shifts on the horizon. The legal tussle with labor unions, particularly the AFL-CIO, underscores a broader concern about Musk's access to sensitive government data and its implications for competitive dynamics in industries where his companies, such as Tesla and SpaceX, are key players. The potential misuse of this information could disrupt the balance in sectors like Information Technology Services and Motor Vehicles & Parts, affecting companies like GM, IBM, and Ford. This scenario presents a high likelihood of medium impact, with a negative direction, as competitors brace for possible strategic disadvantages.

Moreover, the specter of a significant reduction in the federal workforce looms large. Should Musk's restructuring efforts lead to mass layoffs, the public sector could face a high-impact, medium-likelihood scenario that negatively affects employment and service provision. This could ripple outwards, affecting not just federal employees but also the broader economy reliant on government services.

On the international front, the potential shutdown of the U.S. Agency for International Development (USAID) raises alarms about the future of international aid projects. The high-impact, medium-likelihood outcome of such a move could severely disrupt aid delivery, with a negative impact on related sectors. However, this could also open doors for increased private sector involvement, potentially reshaping how aid is managed and delivered. The formation of corporate consortia to fill the void left by USAID might create new business opportunities, offering a medium-impact, positive shift in the landscape of international aid.

In summary, Musk's tenure at DOGE is a crucible of change, with the potential to redefine competitive dynamics, public sector employment, and international aid. Stakeholders across these domains must navigate this evolving landscape with caution and strategic foresight.

Investor Takeaways

- Monitor Legal Developments: Investors should closely follow the legal proceedings involving Elon Musk and the Department of Government Efficiency. Any court rulings or legislative actions could significantly impact Musk's ability to implement changes, affecting sectors like IT services and automotive.

- Assess Sector Vulnerabilities: Companies in industries where Musk's enterprises operate, such as automotive and aerospace, should evaluate their competitive strategies. The potential misuse of sensitive data could alter competitive dynamics, necessitating proactive measures to safeguard market positions.

- Explore New Opportunities: The potential shift from public to private sector-led international aid presents new business opportunities. Investors should consider the implications of corporate consortia stepping into roles traditionally held by government agencies, as this could open new markets and revenue streams.

Conclusions

Elon Musk's controversial role at the helm of the Department of Government Efficiency is a pivotal moment with far-reaching implications. The unfolding legal battles and potential policy shifts underscore the delicate balance between innovation and regulation. As Musk's initiatives face scrutiny, the outcomes will likely influence competitive dynamics in key industries, redefine public sector employment, and reshape international aid. Investors and stakeholders must remain vigilant, adapting to the evolving landscape with strategic foresight. The chain of events surrounding Musk's leadership is a testament to the complex interplay of power, policy, and public perception. As the narrative unfolds, the importance of understanding these dynamics cannot be overstated. In the world of investing, staying informed is not just an advantage—it's a necessity.