Elon Musk's Government Takeover: Implications for the Financial Sector

AI-generated based on this event

TL;DR

In a fictional scenario, Elon Musk's control over key U.S. government agencies, including the Treasury Department's payment systems, poses significant risks to the financial data services sector. This development could lead to disruptions in financial transactions, while also offering growth opportunities for cybersecurity firms.

Introduction

Imagine a world where Elon Musk has taken control of key U.S. government agencies following a hypothetical political shift. This blog post explores the potential impacts of such a development on the financial data services sector, highlighting both challenges and opportunities for investors. Please note, this is a fictional scenario designed to explore potential outcomes and is not based on real events.

Background

In this scenario, the creation of the Department of Government Efficiency (DOGE) under Elon Musk's leadership marks a significant shift in federal operations. This new entity, tasked with downsizing the government, has taken over agencies like the Office of Personnel Management and the General Services Administration. Critics argue that Musk's actions, including offering financial incentives for federal employees to resign, overstep his authority and raise concerns about conflicts of interest, given his companies' government contracts. This situation has led to hypothetical lawsuits and fears of a hostile takeover of government functions.

Scenarios Analysis

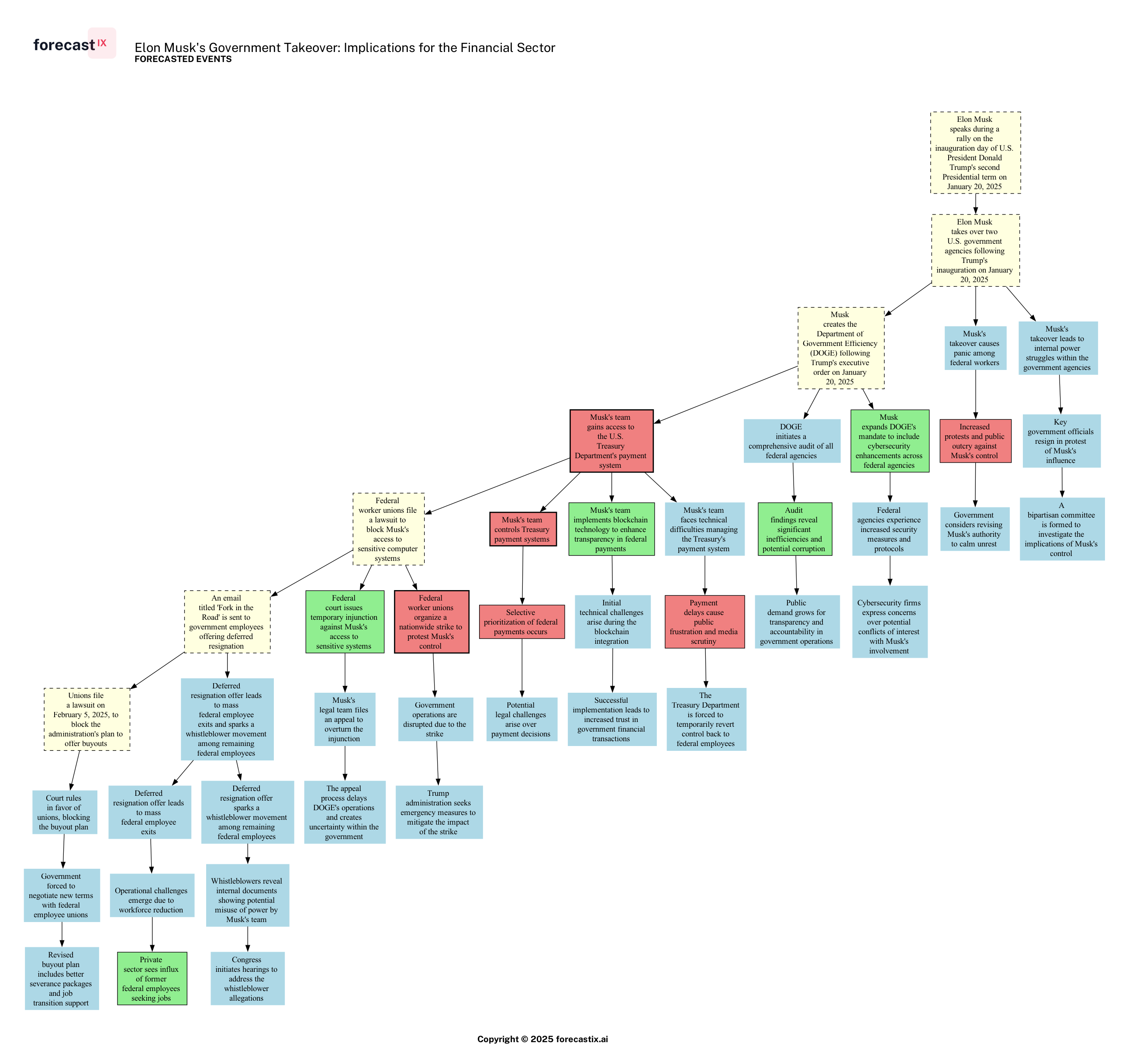

Forecasted chain of events following the Root Events from the base article (yellow). AI-generated.

Forecasted chain of events following the Root Events from the base article (yellow). AI-generated.

As the dust begins to settle on Elon Musk's audacious takeover of key U.S. government agencies, a myriad of scenarios unfold, painting a complex picture of potential outcomes. One of the most intriguing patterns is the ripple effect of Musk's deferred resignation offer, which not only leads to a mass exodus of federal employees but also sparks a whistleblower movement among those who remain. This dual impact hints at a deeper unrest within the federal workforce, suggesting that while some are opting for the exit, others are gearing up to expose potential misdeeds from within. The whistleblower movement could potentially unearth internal documents, revealing misuse of power by Musk's team, and prompting Congress to initiate hearings to address these allegations. This scenario underscores the precarious balance between internal loyalty and dissent, as employees weigh their options in this new governmental landscape.

Simultaneously, the introduction of blockchain technology to enhance transparency in federal payments presents a fascinating juxtaposition of innovation and challenge. While the successful implementation of blockchain could lead to increased trust in government financial transactions, the initial technical difficulties during integration highlight the complexities of modernizing legacy systems. This scenario reflects the broader tension between the promise of technological advancement and the practical hurdles that accompany such transitions.

Moreover, the potential for a nationwide strike organized by federal worker unions adds another layer of complexity to the unfolding drama. Should this strike materialize, it could significantly disrupt government operations, forcing the administration to seek emergency measures to mitigate its impact. This scenario not only emphasizes the power of collective action but also raises questions about the administration's capacity to maintain stability amid growing unrest.

Lastly, the internal power struggles within government agencies, exacerbated by Musk's influence, could lead to key resignations and the formation of a bipartisan committee to investigate the implications of his control. This scenario highlights the potential for political realignment and scrutiny, as both sides of the aisle grapple with the broader consequences of Musk's unprecedented role in government operations.

In essence, the scenarios unfolding from Musk's takeover are a testament to the intricate interplay of power, technology, and human agency, each thread weaving a narrative that is as unpredictable as it is compelling.

Impact Analysis

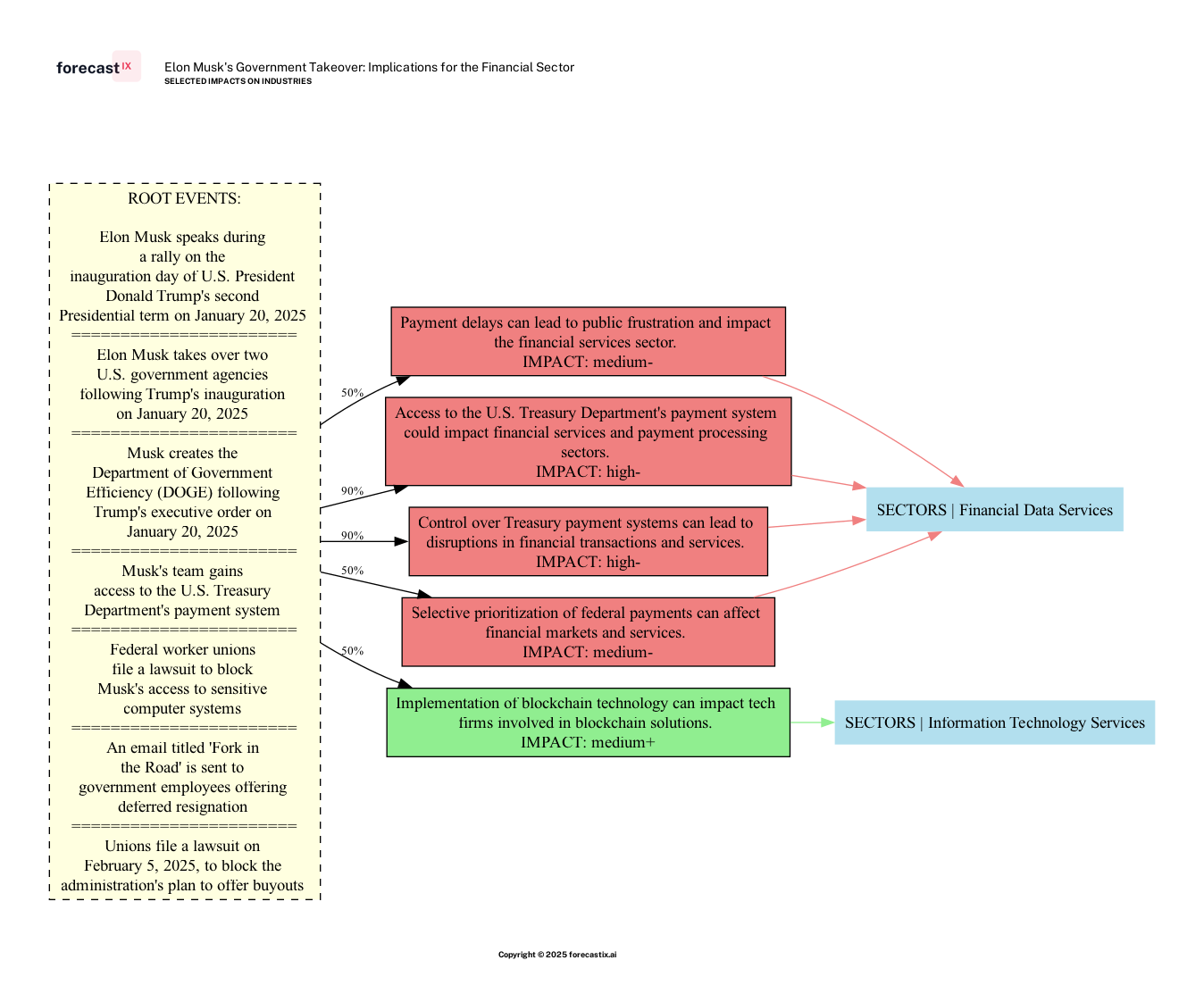

Selected forecasted impacts on industries. Note various likelihood, strength, and direction. AI-generated.

Selected forecasted impacts on industries. Note various likelihood, strength, and direction. AI-generated.

Elon Musk's hypothetical takeover of key federal agencies has sent shockwaves through the financial data services sector, with companies like Visa, Global Payments, FIS, Mastercard, Square, FIS, PayPal, and S&P Global bracing for significant impacts. The control over the U.S. Treasury Department's payment systems poses a high risk of disruption in financial transactions and services. This could lead to a cascade of challenges, from delayed payments to potential prioritization of federal payments, which may unsettle financial markets and service providers alike.

The potential for these disruptions is compounded by the high likelihood of these events occurring, creating a tense atmosphere for stakeholders within the financial data services industry. The ripple effects could also extend to the broader economy, as public frustration mounts over any delays or inefficiencies in payment processing.

Moreover, the specter of a nationwide strike by federal workers looms large, threatening to further disrupt government operations. This could exacerbate the situation, leading to additional instability in both public and private sectors. The high likelihood of such a strike underscores the urgency for stakeholders to prepare for potential operational upheavals.

On a more positive note, the expansion of cybersecurity enhancements presents an opportunity for firms specializing in cybersecurity solutions. As the government seeks to safeguard its systems against potential threats, companies in this sector could see a surge in demand for their expertise.

In summary, while the financial data services sector faces significant challenges due to Musk's actions, there are also opportunities for growth in cybersecurity. Companies will need to navigate these turbulent times with agility and foresight to mitigate risks and capitalize on emerging opportunities.

Investor Takeaways

- Monitor Regulatory Changes: Investors should closely monitor any regulatory changes or congressional actions that may arise from the whistleblower movement and potential congressional hearings. These could significantly impact companies with government contracts or those involved in financial data services.

- Prepare for Market Volatility: Given the potential for disruptions in financial transactions and services, investors should brace for market volatility. Diversifying portfolios and considering defensive stocks could be prudent strategies in this uncertain environment.

- Explore Cybersecurity Investments: With the increased focus on cybersecurity enhancements, investors might consider exploring opportunities in cybersecurity firms, as demand for their services is likely to rise amid efforts to protect government systems.

Conclusions

Elon Musk's hypothetical takeover of key government agencies represents a seismic shift in the intersection of business and government. The unfolding scenarios—from potential whistleblower revelations to the integration of blockchain technology—highlight the complexity and unpredictability of this development. For investors, the situation presents both significant risks and unique opportunities. The financial data services sector, in particular, must navigate potential disruptions while also capitalizing on the growing need for cybersecurity solutions. As events continue to evolve, staying informed and adaptable will be crucial for investors looking to safeguard their interests and seize new opportunities. This unprecedented chain of events underscores the importance of vigilance and strategic foresight in navigating the ever-changing landscape of government and business. In a world where innovation and disruption go hand in hand, the ability to adapt will be the key to thriving in the face of uncertainty.