Navigating the Ripple Effects of Trump's Steel and Aluminum Tariffs

AI-generated based on this event

TL;DR

President Trump's decision to impose a 25% tariff on steel and aluminum imports aims to protect U.S. industries but risks sparking a trade war. Investors should brace for potential volatility as sectors like automotive and construction face higher costs, while domestic metals companies could benefit.

Introduction

In a bold move to protect domestic industries, President Trump has announced a sweeping 25% tariff on steel and aluminum imports, effective March 4, 2023. This decision seeks to bolster U.S. production but has already raised concerns about potential trade wars and economic repercussions. With global trade dynamics hanging in the balance, understanding the implications of this policy shift is crucial for businesses and investors alike.

Background

The announcement of increased tariffs on steel and aluminum imports marks a significant policy shift by the Trump administration. Building on initial tariffs introduced in 2018 under a Cold War-era law, this new measure eliminates previous exemptions, affecting imports from key trading partners like Canada, Brazil, and Mexico. The policy also introduces a North American standard for processing these metals, aiming to curb imports from China and Russia. While the administration argues that these steps will end foreign dumping and secure U.S. industries, the move has drawn criticism and threatens to escalate trade tensions globally.

Scenarios Analysis

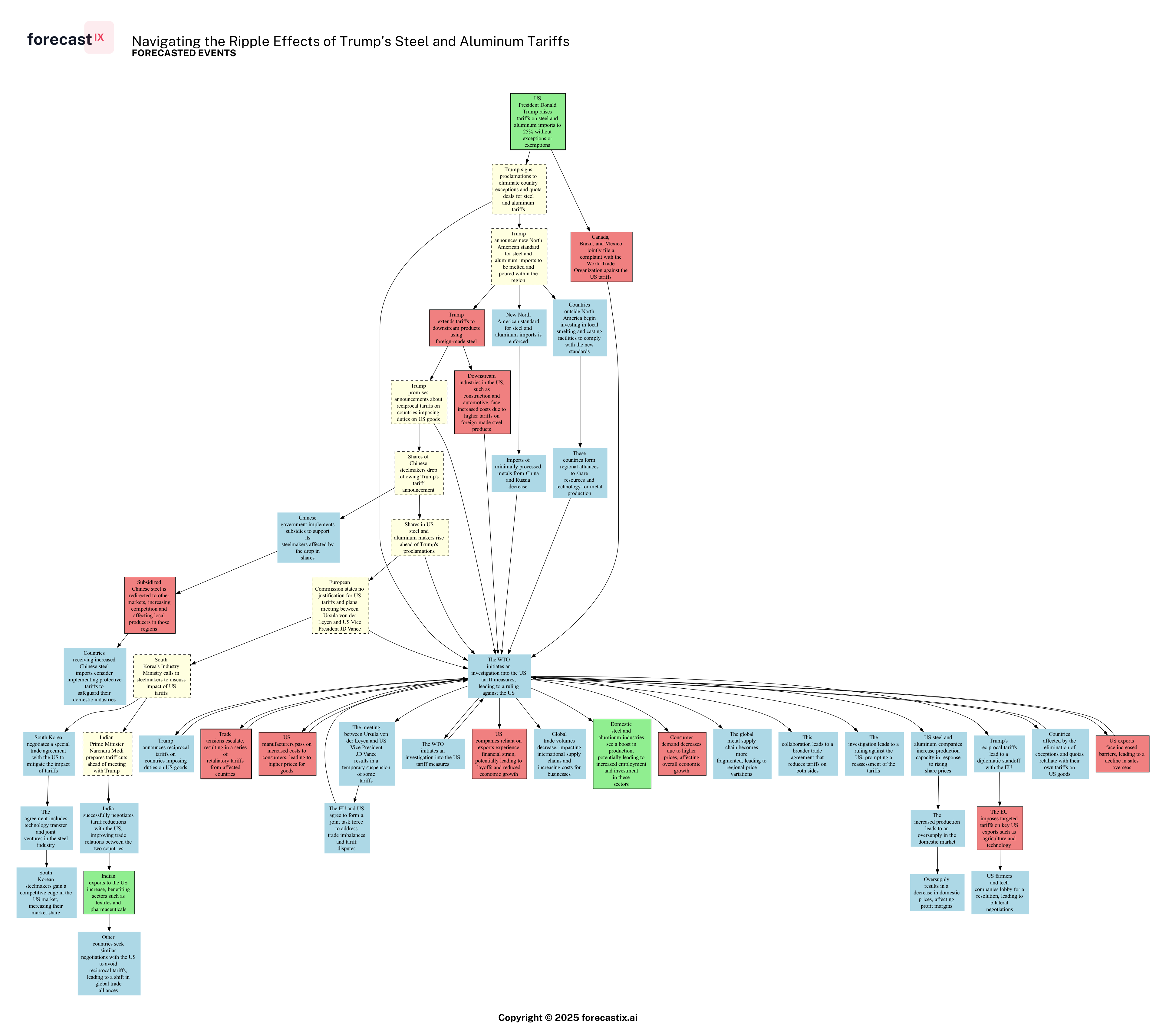

Forecasted chain of events following the Root Events from the base article (yellow). AI-generated.

Forecasted chain of events following the Root Events from the base article (yellow). AI-generated.

In the wake of President Trump's tariff announcement, a cascade of potential scenarios unfolds, painting a vivid picture of the complex and interconnected world of international trade. One of the most immediate reactions is the potential for affected countries to retaliate with their own tariffs on U.S. goods. This tit-for-tat strategy could lead to a decline in U.S. exports, as increased barriers make American products less competitive overseas. The ripple effect of such a decline could strain U.S. companies reliant on exports, potentially leading to financial difficulties, layoffs, and a slowdown in economic growth.

On the domestic front, the introduction of a new North American standard for steel and aluminum imports could bolster local industries. By enforcing that these metals be melted and poured within the region, the policy aims to curb imports of minimally processed metals from China and Russia. This could lead to a boost in production for U.S. steel and aluminum industries, potentially increasing employment and investment. However, this comes with its own set of challenges, as downstream industries like construction and automotive may face higher costs due to the increased tariffs on foreign-made steel products. These costs are likely to be passed on to consumers, resulting in higher prices for goods and potentially dampening consumer demand, which could further affect economic growth.

Internationally, the response from China is particularly noteworthy. With shares of Chinese steelmakers dropping, the Chinese government might implement subsidies to support its affected industries. This could lead to an influx of subsidized Chinese steel into other markets, intensifying competition and prompting local producers in those regions to consider protective tariffs. Such a scenario could further fragment global trade, as countries scramble to protect their domestic industries.

Meanwhile, diplomatic maneuvers are also in play. The European Union, for instance, is poised to engage in discussions with the U.S. to address these trade imbalances. A potential outcome could be the formation of a joint task force, which might pave the way for a broader trade agreement, reducing tariffs on both sides. This diplomatic route could serve as a counterbalance to the escalating tensions, offering a glimmer of hope for a more collaborative global trade environment.

In this intricate web of possibilities, the global metal supply chain stands at a crossroads. As countries outside North America consider investing in local smelting and casting facilities to comply with the new standards, regional alliances might form to share resources and technology. This could lead to a more fragmented global supply chain, with regional price variations becoming the norm.

As these scenarios unfold, the world watches closely, aware that each decision and reaction could have far-reaching implications for economies and industries worldwide. The stakes are high, and the path forward remains uncertain, but one thing is clear: the landscape of international trade is undergoing a profound transformation.

Impact Analysis

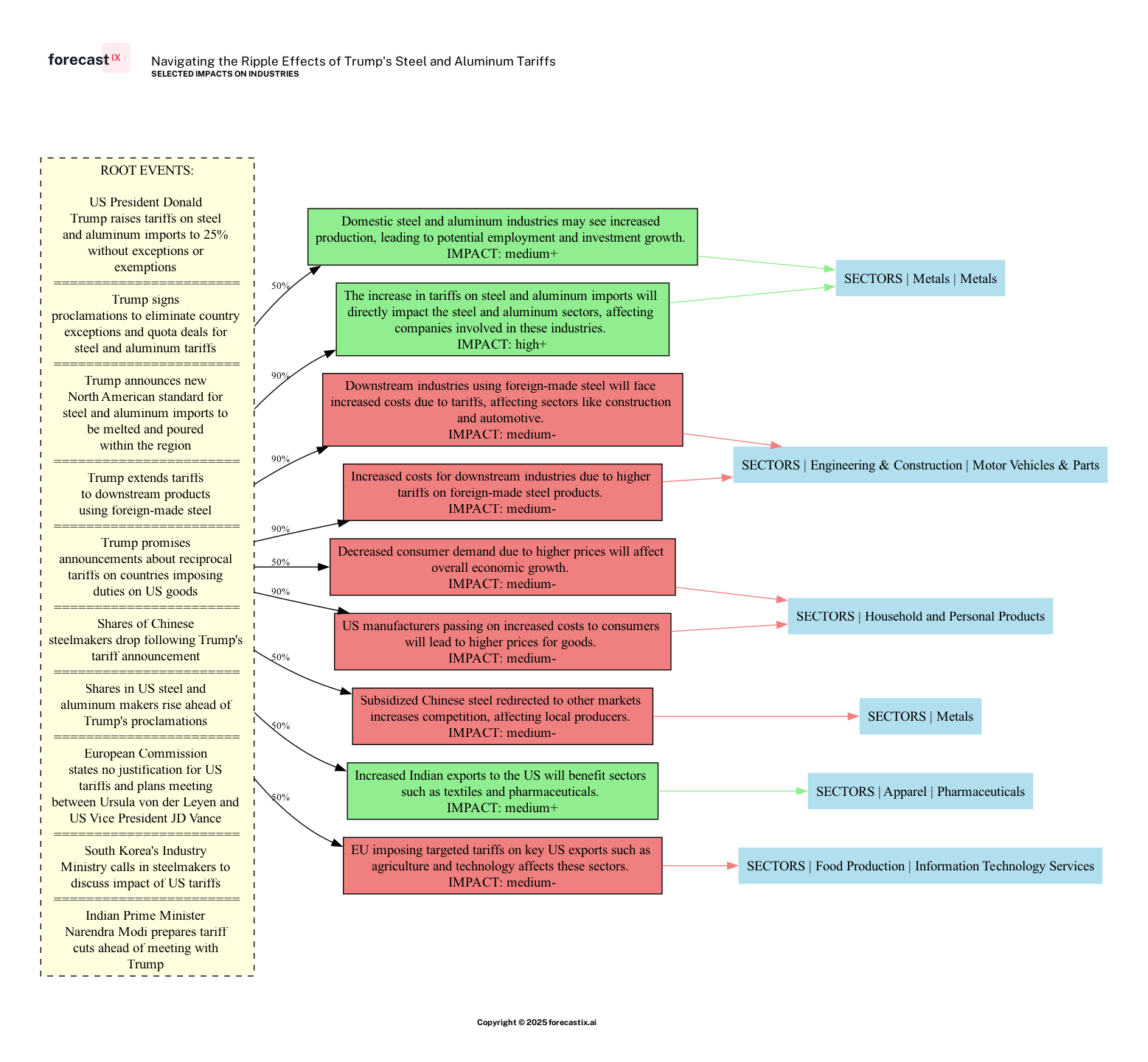

Selected forecasted impacts on industries. Note various likelihood, strength, and direction. AI-generated.

Selected forecasted impacts on industries. Note various likelihood, strength, and direction. AI-generated.

The recent announcement by President Trump to impose a 25% tariff on steel and aluminum imports is poised to send ripples through various sectors of the economy, with the metals industry standing at the epicenter of this seismic shift. Companies like Commercial Metals Company (CMC), Reliance Steel & Aluminum Co. (RS), Cleveland-Cliffs Inc. (CLF), United States Steel Corporation (X), Steel Dynamics, Inc. (STLD), Alcoa Corporation (AA), and Nucor Corporation (NUE) are expected to experience a significant boost. The tariffs are designed to protect domestic production, potentially leading to increased output and investment within these firms. This move could translate into job creation and a more robust domestic metals sector, as the U.S. seeks to curb foreign dumping and secure its industrial base.

However, the broader economic landscape may not be as rosy. Downstream industries, particularly those in engineering, construction, and automotive sectors, are likely to feel the pinch of increased costs. Companies such as Tesla (TSLA), Ford (F), General Motors (GM), and others in the motor vehicles and parts sector will face higher input costs, which could squeeze profit margins and lead to higher prices for consumers. This cost-push inflationary pressure might dampen demand, potentially stalling growth in these sectors.

The ripple effects extend beyond U.S. borders, as the imposition of tariffs could spark retaliatory measures from key trading partners. The potential for a full-blown trade war looms large, with global trade volumes and international supply chains hanging in the balance. This uncertainty could lead to market volatility and strain international relations, as countries like Canada, Brazil, and Mexico, who previously enjoyed duty-free access, are now considering filing complaints with the World Trade Organization (WTO).

Moreover, the prospect of reciprocal tariffs on U.S. exports could further exacerbate the situation. Companies reliant on international sales might face increased barriers, impacting their bottom lines and possibly leading to layoffs and reduced economic growth. The household and personal products sector, including giants like Procter & Gamble (PG) and Kimberly-Clark (KMB), may pass increased costs onto consumers, resulting in higher prices and decreased demand.

On a more positive note, the apparel and pharmaceuticals sectors could see a silver lining, as increased Indian exports to the U.S. might benefit companies like Nike (NKE) and Merck & Co. (MRK). This influx could offset some of the negative impacts by diversifying supply sources and potentially lowering costs in these industries.

In summary, while the tariffs aim to bolster domestic industries, the broader economic implications suggest a complex web of outcomes, with potential gains for some and significant challenges for others. The unfolding trade dynamics will be a critical area to watch, as they hold the key to understanding the future trajectory of both the U.S. and global economies.

Investor Takeaways

- Diversify Investments: Given the potential for increased market volatility due to retaliatory tariffs and trade tensions, investors should consider diversifying their portfolios to mitigate risks. This includes exploring opportunities in sectors less affected by the tariffs, such as technology or healthcare.

- Monitor Key Industries: Keep a close eye on the metals industry and downstream sectors like automotive and construction. Companies within these industries may experience significant shifts in profitability and stock performance, presenting both risks and opportunities for investors.

- Stay Informed on Trade Developments: Investors should stay updated on international trade negotiations and potential retaliatory measures from affected countries. These developments could have a substantial impact on global supply chains and market dynamics, influencing investment strategies.

Conclusions

In conclusion, President Trump's decision to impose tariffs on steel and aluminum imports marks a pivotal moment in international trade, with far-reaching implications for businesses and investors alike. While the policy aims to protect domestic industries, it also introduces a complex web of challenges and opportunities across various sectors. The potential for trade wars, increased costs, and market volatility underscores the importance of strategic planning and diversification for investors. As the global trade landscape continues to evolve, staying informed and adaptable will be crucial in navigating these turbulent times. The chain of events triggered by these tariffs highlights the interconnectedness of global economies and the need for thoughtful, forward-looking strategies. As we move forward, the ability to anticipate and respond to these changes will be key to thriving in an increasingly dynamic market environment.

"In the world of trade, the only constant is change."