Navigating the SEC's New Procedural Changes: What Investors Need to Know

AI-generated based on this event

TL;DR

The SEC now requires Commission approval before launching formal investigations, potentially slowing enforcement but reducing regulatory pressure on companies. This change could encourage market activity but also increase risks of financial misconduct.

Introduction

In a significant shift under new leadership, the SEC has altered its procedural approach to investigations, requiring Commission approval before formal probes can commence. This analysis explores the implications for businesses and investors, highlighting both challenges and opportunities in the evolving regulatory landscape.

Background

Following recent leadership changes, the SEC, under acting chair Mark Uyeda, has implemented a procedural change requiring Commission approval for formal investigations. This move aims to reduce governmental overreach and aligns with an industry-friendly stance. However, it has sparked debate over its impact on the efficiency and autonomy of SEC staff, as well as the broader implications for financial regulation.

Scenarios Analysis

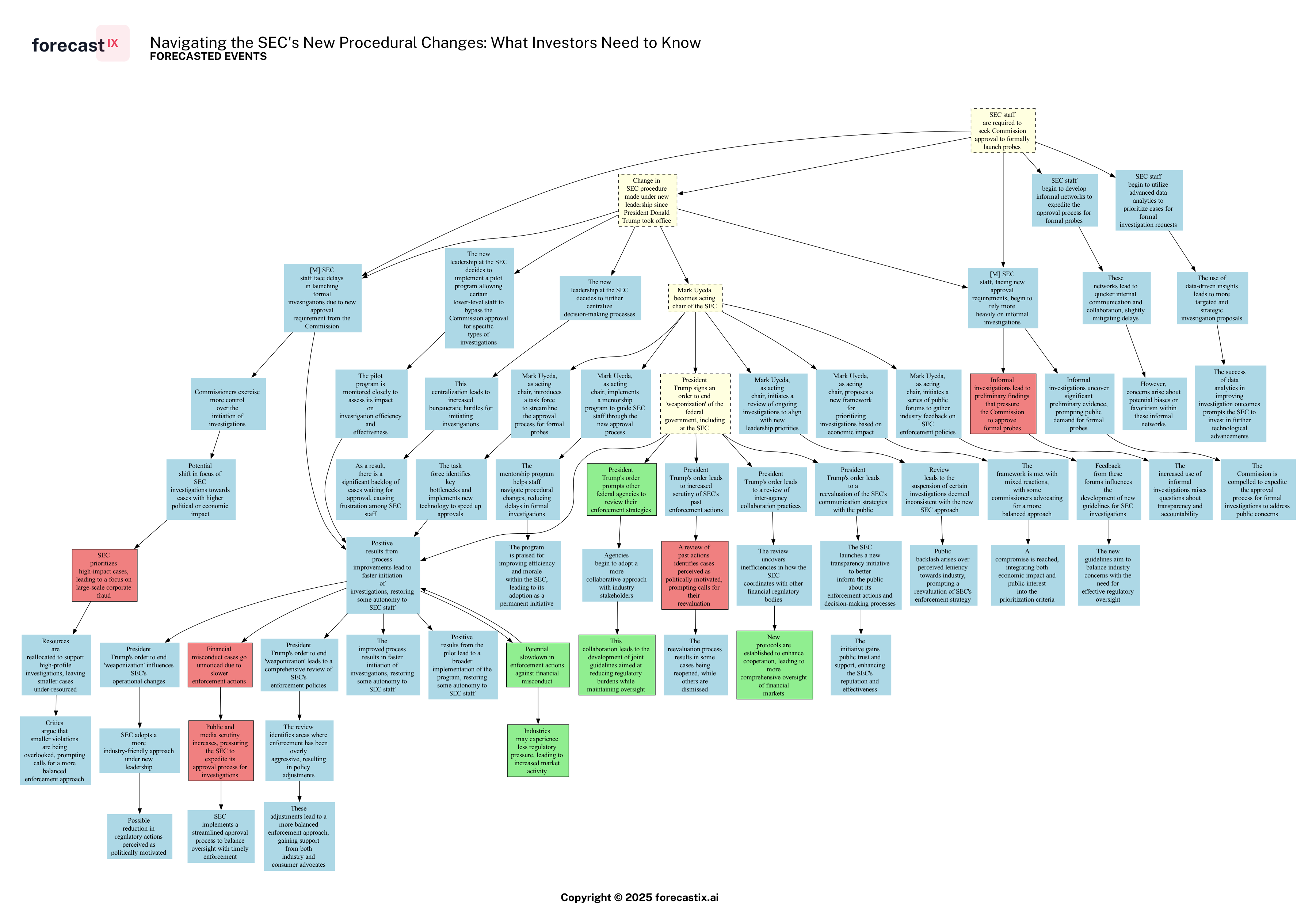

Forecasted chain of events following the Root Events from the base article (yellow). AI-generated.

Forecasted chain of events following the Root Events from the base article (yellow). AI-generated.

As the SEC undergoes a significant procedural transformation under the new leadership, the landscape of financial regulation is poised for intriguing shifts. The requirement for SEC staff to seek Commission approval before launching formal investigations introduces a layer of complexity that could slow down the enforcement process. This change, while aligning with the administration's goal to reduce governmental overreach, raises questions about the balance between oversight and efficiency.

One potential scenario is the emergence of informal networks among SEC staff to expedite the approval process. These networks could foster quicker internal communication and collaboration, slightly mitigating the delays caused by the new approval requirement. However, the development of such networks might also lead to concerns about potential biases or favoritism, highlighting the delicate balance between efficiency and impartiality.

Moreover, the shift towards prioritizing high-impact cases could lead to a focus on large-scale corporate fraud, reallocating resources to support these high-profile investigations. While this strategy might enhance the SEC's ability to tackle significant financial misconduct, it could also result in smaller violations being overlooked. This potential oversight might prompt calls for a more balanced enforcement approach, ensuring that all levels of misconduct are addressed appropriately.

Interestingly, the introduction of advanced data analytics to prioritize cases for formal investigation requests presents a promising avenue for the SEC. By leveraging data-driven insights, the agency could develop more targeted and strategic investigation proposals, improving the overall outcomes of its enforcement actions. This technological advancement could not only enhance the SEC's efficiency but also restore some autonomy to its staff, countering the bureaucratic hurdles introduced by the new approval process.

Finally, the potential for a pilot program allowing certain lower-level staff to bypass the Commission approval for specific types of investigations offers a glimpse of hope for restoring autonomy within the SEC. If successful, this program could lead to a broader implementation, streamlining the investigation process and reducing delays. Such a move would likely be welcomed by SEC staff, who may feel constrained by the current procedural changes.

In summary, while the new SEC leadership's approach introduces challenges, it also opens up opportunities for innovation and improvement. The interplay between regulatory oversight, industry collaboration, and technological advancement will be crucial in shaping the future of financial regulation under this new regime.

Impact Analysis

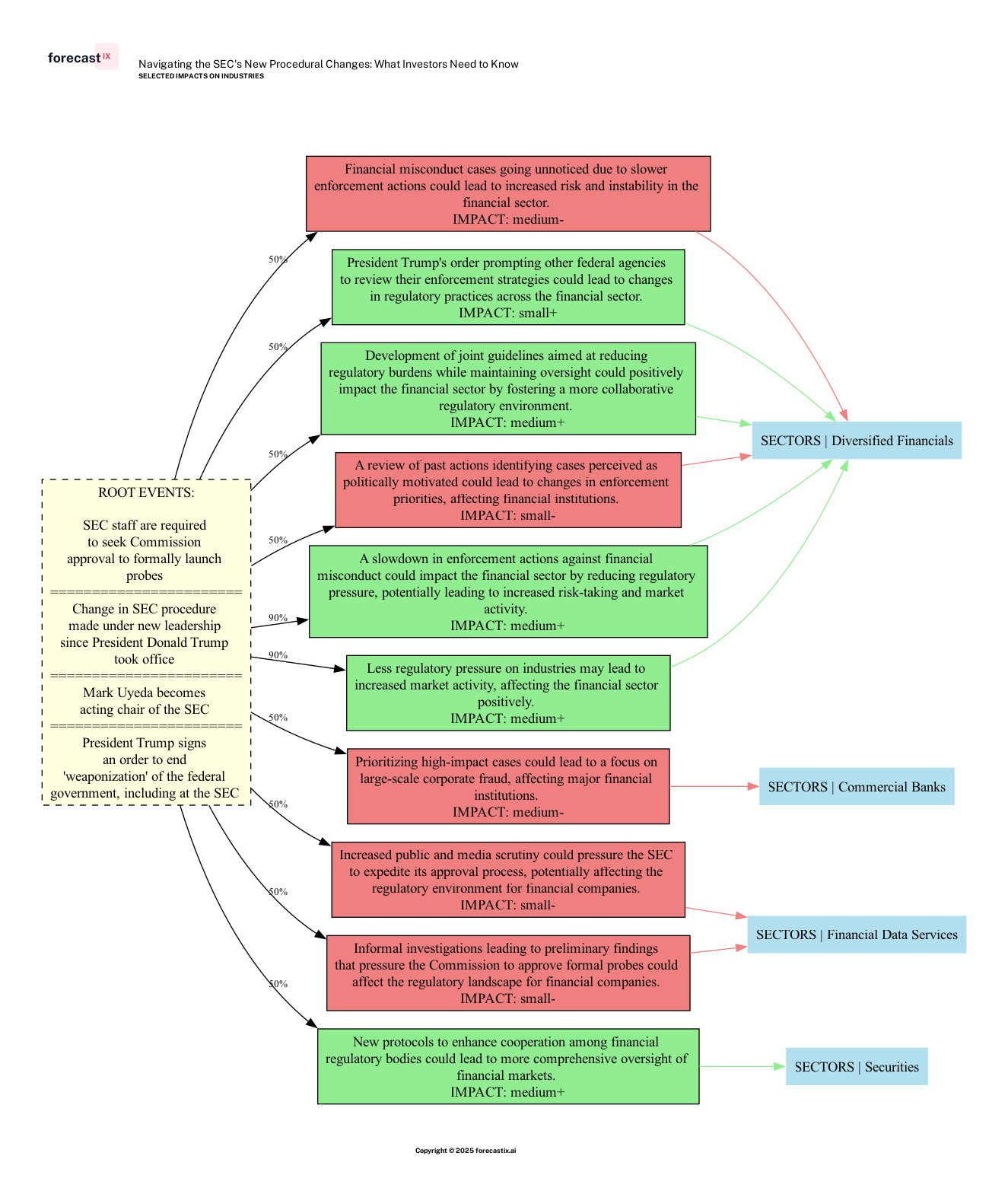

Selected forecasted impacts on industries. Note various likelihood, strength, and direction. AI-generated.

Selected forecasted impacts on industries. Note various likelihood, strength, and direction. AI-generated.

The recent procedural change at the SEC, requiring lawyers to obtain Commission approval before launching investigations, is poised to have a ripple effect across the financial sector. This shift, while aligning with the administration's goal of reducing governmental overreach, could lead to a slowdown in enforcement actions. For companies like Synchrony Financial (SYF), Blackstone (BX), and American Express (AXP), this could mean a reduction in regulatory pressure, potentially encouraging increased risk-taking and market activity. This is particularly relevant for the Diversified Financials sector, where the impact is expected to be medium but positive, given the high likelihood of less stringent oversight.

However, this change is not without its potential pitfalls. The slower pace of enforcement could allow financial misconduct cases to go unnoticed, introducing increased risk and instability within the sector. This dual-edged sword of reduced oversight might benefit companies in the short term but could lead to long-term challenges if misconduct becomes more prevalent.

Moreover, the Commercial Banks sector, including giants like Bank of America (BAC) and JPMorgan Chase (JPM), might see a shift in focus towards high-impact cases of corporate fraud. This prioritization could result in heightened scrutiny for major financial institutions, potentially affecting their operations and compliance strategies.

In the Securities sector, firms such as Apollo Global Management (APO) and BlackRock (BLK) might experience a more collaborative regulatory environment due to new protocols aimed at enhancing cooperation among financial regulatory bodies. This could foster more comprehensive oversight, positively impacting the sector by ensuring a balanced approach to regulation.

Overall, while the immediate impact of the SEC's procedural change might seem beneficial for market activity, the long-term implications could introduce complexities that require careful navigation by financial institutions. The evolving regulatory landscape will demand adaptability and vigilance from companies to maintain their competitive edge while ensuring compliance.

Investor Takeaways

- Monitor Regulatory Developments: Investors should stay informed about the SEC's procedural changes and their potential impacts on enforcement actions. Understanding these shifts can help anticipate changes in regulatory pressure on different sectors.

- Evaluate Risk and Compliance Strategies: With the potential for reduced oversight, investors should assess the risk profiles of their investments, particularly in sectors like Diversified Financials and Commercial Banks. Companies may take on more risk, which could impact long-term stability.

- Leverage Technological Advancements: The SEC's use of data analytics to prioritize cases could signal a broader trend towards technology-driven regulatory strategies. Investors might consider how companies are adopting similar technologies to enhance compliance and operational efficiency.

Conclusions

In conclusion, the SEC's new procedural changes represent a significant shift in the regulatory landscape, with both challenges and opportunities for businesses and investors. While the move towards requiring Commission approval for formal investigations aligns with an industry-friendly approach, it introduces complexities that could affect enforcement efficiency and regulatory oversight. Investors must navigate these changes with a keen eye on risk management and compliance strategies. As the SEC continues to adapt and innovate, leveraging technology and fostering collaboration, the financial sector must remain vigilant and adaptable. The evolving dynamics underscore the importance of understanding regulatory developments and their potential impacts on market behavior. In this ever-changing environment, staying informed and proactive will be key to maintaining a competitive edge.

"In the world of finance, the only constant is change. Embrace it, adapt to it, and thrive."