Navigating Trade Tensions: Impacts on Key Sectors and Companies

AI-generated based on this event

TL;DR

Recent U.S. tariff decisions and corporate earnings reports have created a mixed bag of impacts for investors. While some sectors benefit from delayed tariffs on Mexico and Canada, others face challenges from new tariffs on Chinese imports.

Introduction

In the ever-evolving landscape of global trade, recent developments in U.S. tariffs and corporate earnings have sparked significant interest among investors. This analysis aims to unravel the complex interplay of these events, highlighting their potential impacts on key sectors and companies. Investors can expect insights into how these dynamics might shape future market conditions.

Background

On February 4, 2023, major U.S. stock indexes saw gains driven by optimism over U.S.-China trade talks and a delay in tariffs on Mexico and Canada. President Trump's decision to pause tariffs for 30 days in exchange for concessions has provided temporary relief to investors. However, new tariffs on Chinese imports continue to pose inflation risks, as noted by Federal Reserve officials. Meanwhile, Merck's Gardasil vaccine shipments to China have faced setbacks, impacting its revenue forecasts.

Scenarios Analysis

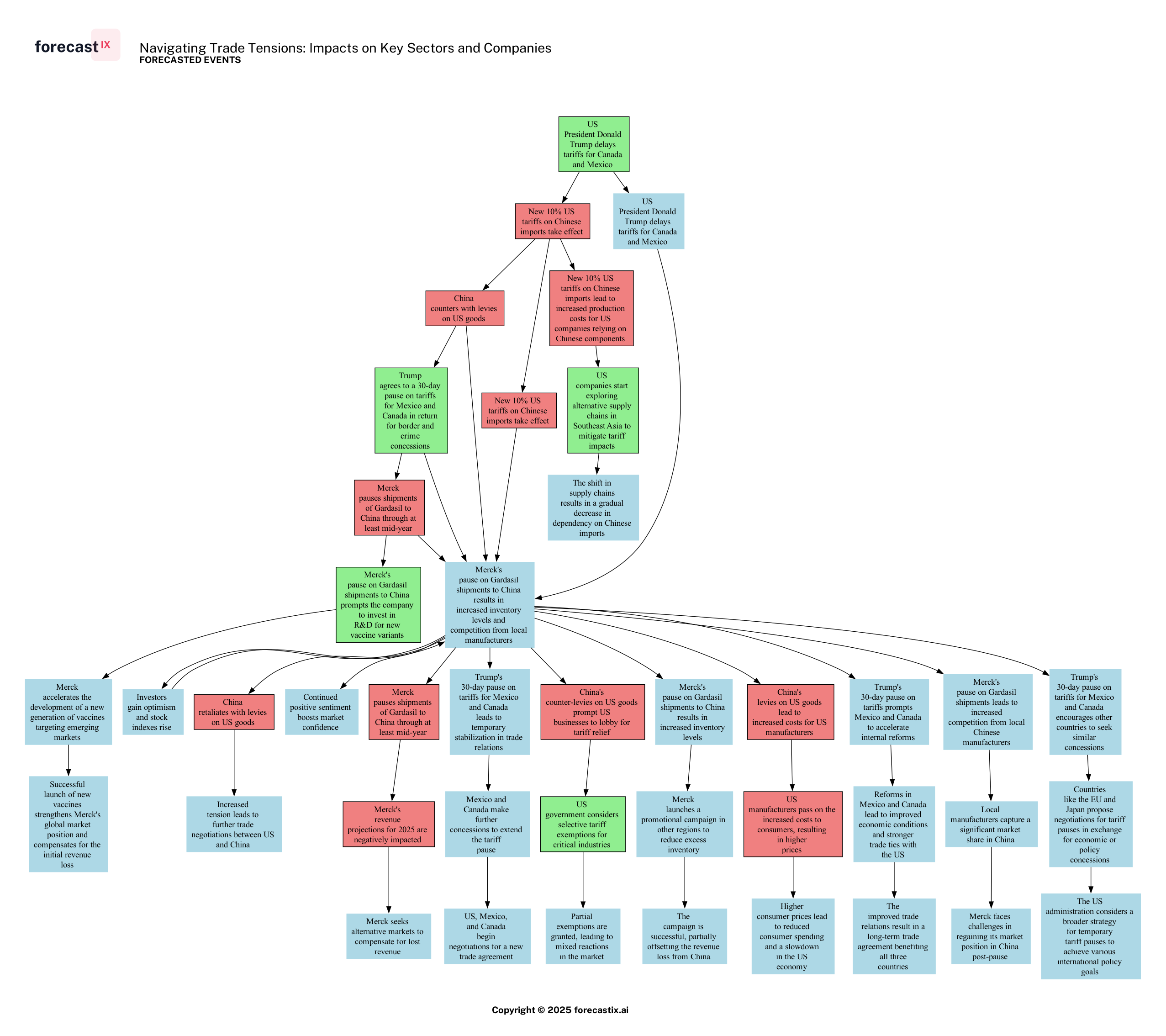

Forecasted chain of events following the Root Events from the base article (yellow). AI-generated.

Forecasted chain of events following the Root Events from the base article (yellow). AI-generated.

In the intricate dance of global trade and corporate maneuvering, the recent developments in U.S. tariffs and Merck's strategic shifts paint a vivid picture of the interconnectedness of international markets. One of the most intriguing scenarios unfolding is the ripple effect of President Trump's decision to delay tariffs on Canada and Mexico. This move not only provided a temporary sigh of relief for investors but also set the stage for potential long-term benefits. The pause has prompted Mexico and Canada to accelerate internal reforms, which could lead to improved economic conditions and stronger trade ties with the U.S. If these reforms are successful, they might culminate in a long-term trade agreement that benefits all three countries, showcasing how a tactical delay can foster deeper economic integration.

Meanwhile, Merck's pause on Gardasil shipments to China has sparked a flurry of strategic responses. The halt has led to increased competition from local Chinese manufacturers, who are eager to capture market share. This competitive pressure could challenge Merck's market position in China, forcing the company to innovate and adapt. In response, Merck is exploring alternative markets and investing in the development of new vaccine variants. This proactive approach not only aims to mitigate the immediate revenue loss but also positions Merck to strengthen its global market presence. By accelerating the development of a new generation of vaccines targeting emerging markets, Merck could potentially offset the initial setbacks and emerge stronger, illustrating the resilience and adaptability required in today's volatile market landscape.

Moreover, the new U.S. tariffs on Chinese imports have prompted U.S. companies to reconsider their supply chains. The increased production costs are driving these companies to explore alternatives in Southeast Asia, which could gradually reduce their dependency on Chinese imports. This shift not only highlights the adaptability of businesses in response to geopolitical tensions but also underscores the broader trend of diversifying supply chains to enhance resilience against future disruptions.

In essence, these scenarios underscore a common theme: the ability to pivot and adapt in the face of challenges is crucial for businesses and economies alike. Whether it's through strategic pauses, competitive innovation, or supply chain diversification, the capacity to navigate and leverage these complex dynamics will determine the winners in the ever-evolving global marketplace.

Impact Analysis

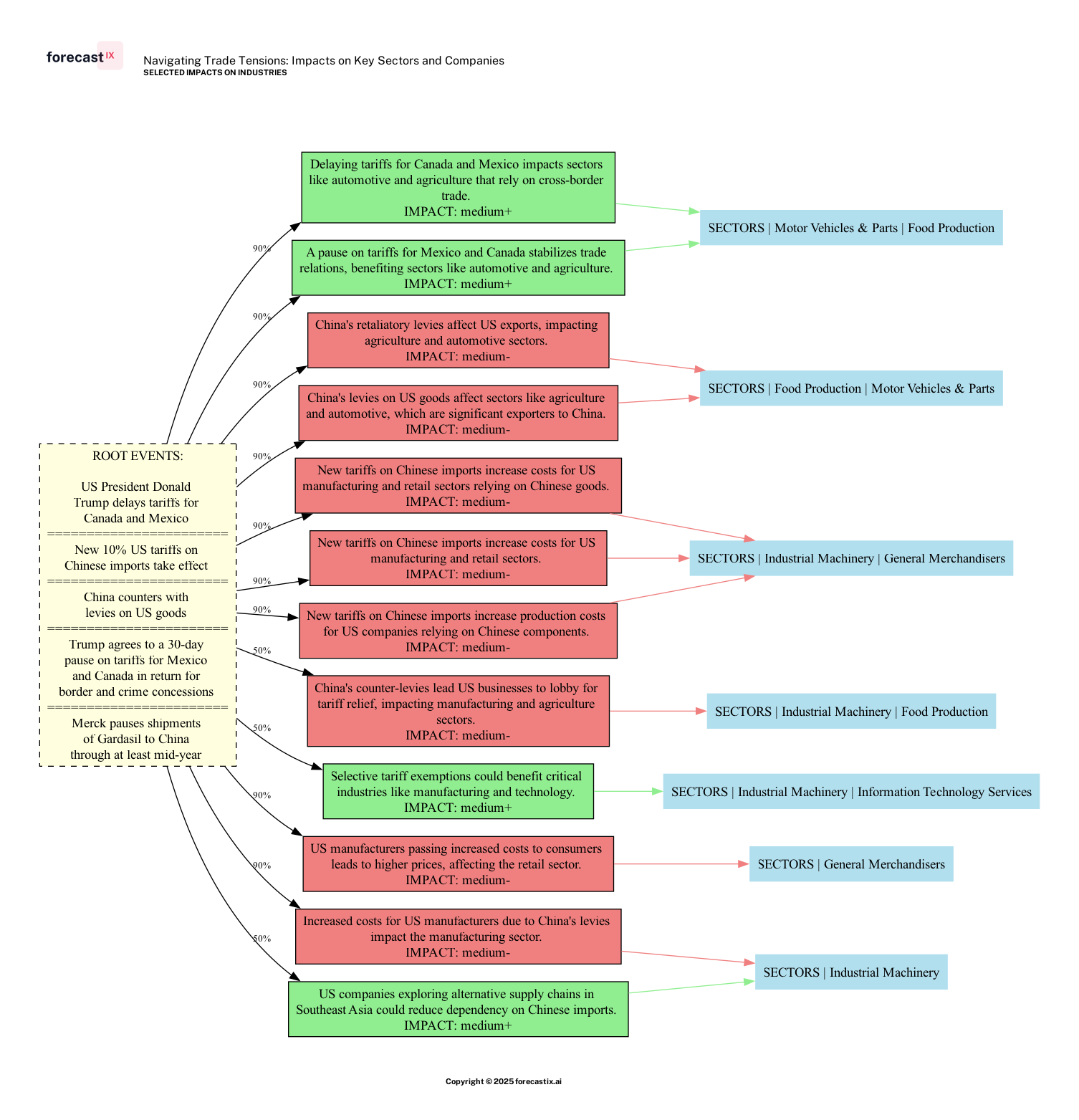

Selected forecasted impacts on industries. Note various likelihood, strength, and direction. AI-generated.

Selected forecasted impacts on industries. Note various likelihood, strength, and direction. AI-generated.

The recent developments in U.S. trade policy and corporate earnings have set the stage for a complex interplay of impacts across various sectors. The delay in imposing tariffs on Mexico and Canada has provided a much-needed reprieve for the automotive and agriculture sectors, which are heavily reliant on cross-border trade. Companies like General Motors and Ford, along with agricultural giants such as Archer Daniels Midland, are likely to experience a positive impact from this pause, as it stabilizes trade relations and mitigates immediate cost pressures.

Conversely, the introduction of new tariffs on Chinese imports is poised to exert upward pressure on costs for U.S. manufacturers and retailers. This scenario spells trouble for companies like Emerson Electric and General Electric, which are entrenched in the industrial machinery sector, as well as retail giants such as Walmart and Target. The increased costs could ripple through to consumers, potentially leading to higher prices in retail stores, which may dampen consumer spending.

Merck's challenges with its Gardasil vaccine shipments to China highlight the vulnerabilities companies face in international markets. The pause in shipments is a significant setback, directly impacting Merck's revenue forecasts and market position in China. However, Merck's strategic investment in research and development for new vaccine variants could eventually bolster its market standing, offering a silver lining amidst the current challenges.

Overall, while some sectors are buoyed by the temporary relief in North American trade tensions, the broader landscape remains fraught with challenges due to ongoing trade disputes and their associated economic ramifications. As companies navigate these turbulent waters, strategic adaptations and innovations will be crucial in mitigating risks and capitalizing on emerging opportunities.

Investor Takeaways

- Diversification of Supply Chains: Investors should monitor companies that are actively diversifying their supply chains to reduce dependency on Chinese imports. This strategy not only mitigates risks associated with geopolitical tensions but also positions companies to capitalize on emerging markets in Southeast Asia.

- Sector-Specific Opportunities: The automotive and agriculture sectors are poised to benefit from the temporary reprieve in tariffs on Mexico and Canada. Investors might consider exploring opportunities in companies within these sectors, such as General Motors, Ford, and Archer Daniels Midland, which could experience stability and growth in the near term.

- Innovation and R&D Focus: Companies like Merck that are investing in research and development to innovate and adapt to market challenges may offer long-term growth potential. Investors should keep an eye on firms that prioritize R&D to navigate international market disruptions and maintain competitive advantages.

Conclusions

The intricate web of global trade tensions and corporate strategies presents both challenges and opportunities for investors. The temporary delay in tariffs on Mexico and Canada offers a glimpse of potential stability for certain sectors, while the ongoing tariffs on Chinese imports underscore the need for strategic supply chain diversification. Merck's situation exemplifies the importance of innovation and adaptability in maintaining market presence amidst international challenges.

As we look forward, the ability of companies to pivot and adapt in response to these evolving dynamics will be crucial. Investors should remain vigilant, focusing on sectors and companies that demonstrate resilience and strategic foresight. The unfolding events in global trade serve as a reminder of the interconnectedness of markets and the importance of staying informed and agile in investment strategies.

In the ever-changing landscape of global trade, the only constant is change itself. Investors who embrace this reality and adapt accordingly will be well-positioned to navigate the complexities of the market and seize emerging opportunities.