The One Agency Act: A New Era for Antitrust Enforcement?

AI-generated based on this event

TL;DR

The One Agency Act, endorsed by Elon Musk, proposes to centralize antitrust enforcement under the DOJ, sparking debates on its impact on tech giants and consumer protection.

Introduction

In a bold move towards regulatory reform, the One Agency Act seeks to consolidate antitrust enforcement under the U.S. Department of Justice. This proposal, championed by Senator Mike Lee and endorsed by Elon Musk, has stirred significant interest and debate among lawmakers, businesses, and investors. This article delves into the potential implications of this legislative shift, exploring how it could reshape the regulatory landscape for key sectors and what it means for investors navigating this evolving terrain.

Background

The One Agency Act, introduced in February 2024, aims to streamline antitrust oversight by centralizing it within the DOJ, removing this responsibility from the FTC. While the DOJ would gain enhanced authority, the FTC would continue to enforce consumer protection laws. This proposal has sparked a partisan debate, with Democrats concerned about the potential weakening of antitrust protections. The bill is currently under consideration in the U.S. House, with no official comments from the FTC or DOJ yet. Elon Musk's endorsement has amplified public interest, adding pressure on lawmakers to address the bill's implications.

Scenarios Analysis

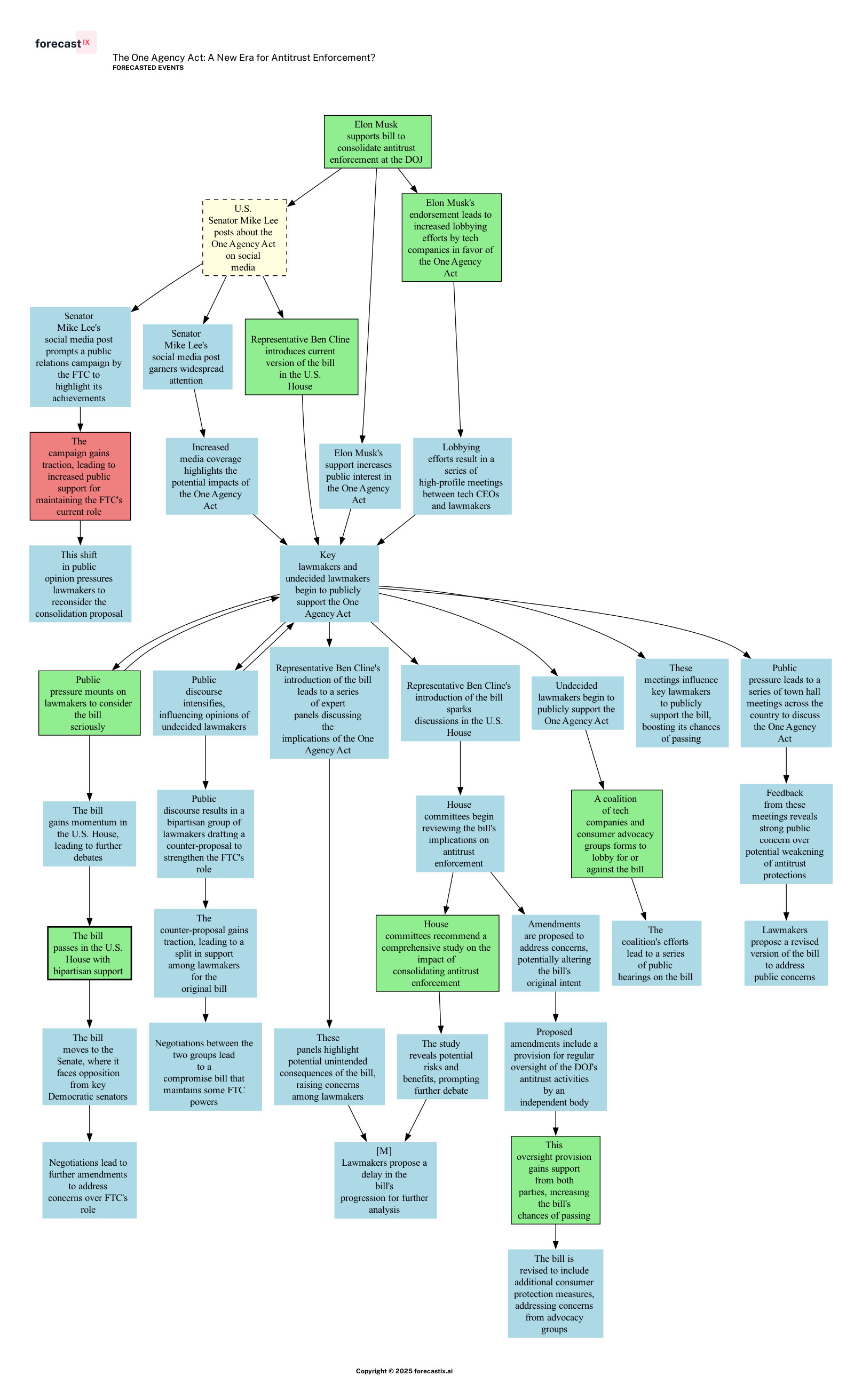

Forecasted chain of events following the Root Events from the base article (yellow). AI-generated.

Forecasted chain of events following the Root Events from the base article (yellow). AI-generated.

As the One Agency Act gains traction, a fascinating web of scenarios unfolds, each with its own set of implications for the future of antitrust enforcement in the United States. One of the most intriguing patterns is the interplay between public opinion and legislative action. Elon Musk's endorsement of the bill has undeniably amplified public interest, leading to increased pressure on lawmakers to take the proposal seriously. This surge in public engagement is not just a passive observation; it actively shapes the legislative landscape, as seen in the mounting momentum in the U.S. House and the subsequent debates it sparks.

Another compelling scenario is the potential for a counter-proposal to emerge, driven by public discourse and concerns over the possible weakening of antitrust protections. This counter-proposal, which aims to strengthen the FTC's role, highlights the dynamic nature of legislative processes, where public feedback can lead to significant shifts in policy direction. The emergence of a bipartisan group of lawmakers drafting this counter-proposal suggests that the original bill may face substantial challenges, potentially leading to a split in support and necessitating a compromise that balances the powers of both the DOJ and the FTC.

Moreover, the role of lobbying efforts by tech companies adds another layer of complexity. As these companies ramp up their advocacy for the One Agency Act, high-profile meetings between tech CEOs and lawmakers could sway key decision-makers, further boosting the bill's chances of passing. However, this also raises questions about the influence of corporate interests in shaping antitrust policy, a topic that is likely to fuel further public debate and scrutiny.

Lastly, the potential for amendments to include provisions for regular oversight of the DOJ's antitrust activities by an independent body introduces an intriguing twist. This oversight mechanism could serve as a compromise to address concerns from both sides of the aisle, increasing the bill's likelihood of passing while ensuring that consumer protection remains a priority. This scenario underscores the importance of checks and balances in maintaining fair competition and protecting consumer interests, even as antitrust enforcement undergoes significant restructuring.

In essence, the unfolding scenarios around the One Agency Act illustrate a complex dance between public opinion, legislative maneuvering, and corporate lobbying, each influencing the other in a delicate balance of power and policy.

Impact Analysis

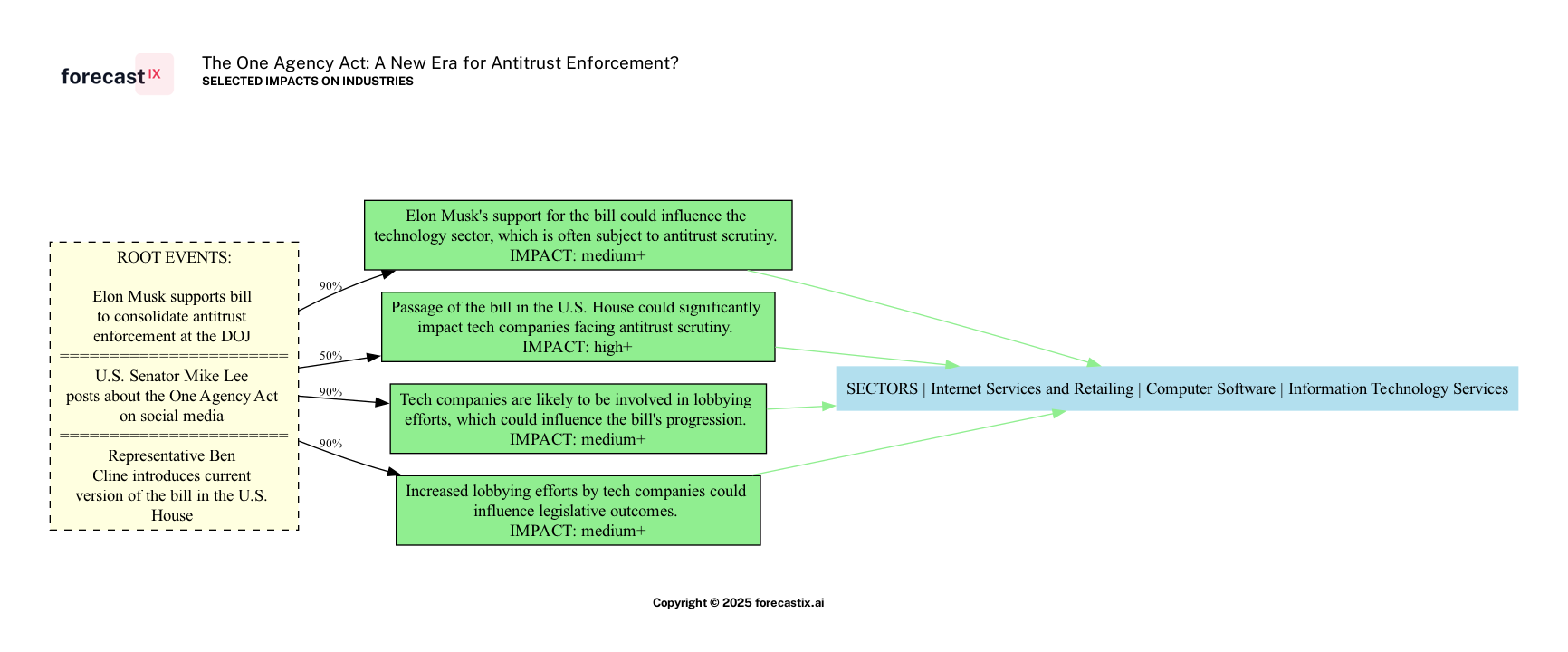

Selected forecasted impacts on industries. Note various likelihood, strength, and direction. AI-generated.

Selected forecasted impacts on industries. Note various likelihood, strength, and direction. AI-generated.

As the One Agency Act makes its way through the legislative corridors, the tech industry finds itself at the crossroads of potential regulatory transformation. Elon Musk's endorsement of this bill is not just a nod of approval but a signal that could reverberate across the technology landscape. With the DOJ poised to become the sole arbiter of antitrust enforcement, tech giants like Google, Amazon, and Microsoft, along with a host of other companies, could find themselves navigating a new regulatory terrain.

The consolidation of antitrust oversight under the DOJ is expected to have a profound impact on the Internet Services and Retailing, Computer Software, and Information Technology Services sectors. These industries, often under the microscope for antitrust issues, could experience a shift in how they strategize and operate. The potential passage of the bill in the U.S. House is a pivotal moment, with the likelihood of significant changes in how antitrust laws are enforced. This could lead to a more streamlined process, but also raises concerns about the loss of the FTC's nuanced approach to consumer protection.

The tech sector's response is likely to be robust, with increased lobbying efforts as companies seek to influence the bill's progression. This lobbying could shape the legislative outcome, potentially altering the competitive landscape. Companies such as Uber, Meta, and Booking Holdings may find themselves at the forefront of these efforts, striving to ensure that the new regulatory framework aligns with their business models and growth strategies.

Moreover, the FTC's campaign to maintain its role in antitrust enforcement could introduce an element of uncertainty. As public opinion and legislative decisions hang in the balance, the outcome of this regulatory reshuffle remains to be seen. The stakes are high, and the tech industry is watching closely, ready to adapt to whatever changes may come.

Investor Takeaways

- Monitor Legislative Developments: Investors should closely follow the progress of the One Agency Act and any potential counter-proposals. The outcomes could significantly impact the regulatory environment, particularly for tech companies. Staying informed will help investors anticipate changes in market dynamics and adjust their portfolios accordingly.

- Assess Sector-Specific Risks and Opportunities: With the DOJ potentially taking over antitrust enforcement, sectors like technology and retailing may face new regulatory challenges. Investors should evaluate how these changes could affect company valuations and competitive positioning, looking for opportunities in firms that may benefit from a streamlined regulatory process.

- Consider the Influence of Corporate Lobbying: The role of tech giants in shaping the legislative outcome cannot be underestimated. Investors should be aware of how corporate lobbying might influence the final form of the bill and the implications for market competition and innovation.

Conclusions

The One Agency Act represents a pivotal moment in the evolution of antitrust enforcement in the United States. By consolidating oversight under the DOJ, this legislative proposal could redefine the regulatory landscape, particularly for the technology sector. As public opinion, legislative maneuvering, and corporate lobbying converge, the outcome remains uncertain but full of potential.

For investors, the key lies in understanding these dynamics and preparing for the shifts they may bring. The interplay of these forces underscores the importance of vigilance and adaptability in investment strategies. As the regulatory framework evolves, so too must the approaches of those navigating it.

In this era of transformation, staying informed and proactive will be crucial for investors seeking to capitalize on the opportunities and mitigate the risks posed by this legislative shift. The One Agency Act is not just a regulatory change; it is a harbinger of a new era in antitrust enforcement, one that demands careful consideration and strategic foresight.