Ukraine's Strategic Mineral Partnership: A Game Changer for Global Markets

AI-generated based on this event

TL;DR

Ukraine's proposal for a mineral partnership with the U.S. could reshape global supply chains, impacting sectors like mining, defense, and energy. This strategic move aims to bolster Ukraine's economy and military efforts while reducing Europe's reliance on Russian energy. Key points include:

- Potential increase in U.S. investment in Ukraine's mineral resources.

- Ukraine's emergence as a European energy hub.

- Opportunities for U.S. companies in mining, defense, and energy sectors.

Introduction

In a bold geopolitical maneuver, Ukrainian President Volodymyr Zelenskiy has proposed a mineral partnership with the United States, aiming to leverage Ukraine's vast deposits of rare earths and critical minerals. This partnership could redefine Ukraine's economic and strategic role on the global stage, offering significant opportunities for investors as the country seeks to strengthen its economy and military capabilities.

Background

Ukraine's ongoing conflict with Russia has highlighted the need for strategic alliances and economic support. With its rich mineral resources, particularly rare earths essential for high-tech manufacturing, Ukraine presents a unique opportunity for collaboration with the U.S. Beyond minerals, Ukraine aims to position itself as a key energy hub for Europe, potentially altering the continent's energy dynamics and reducing dependency on Russian gas. These developments are set against the backdrop of Ukraine's strategic priorities, as highlighted at the Munich Security Conference.

Scenarios Analysis

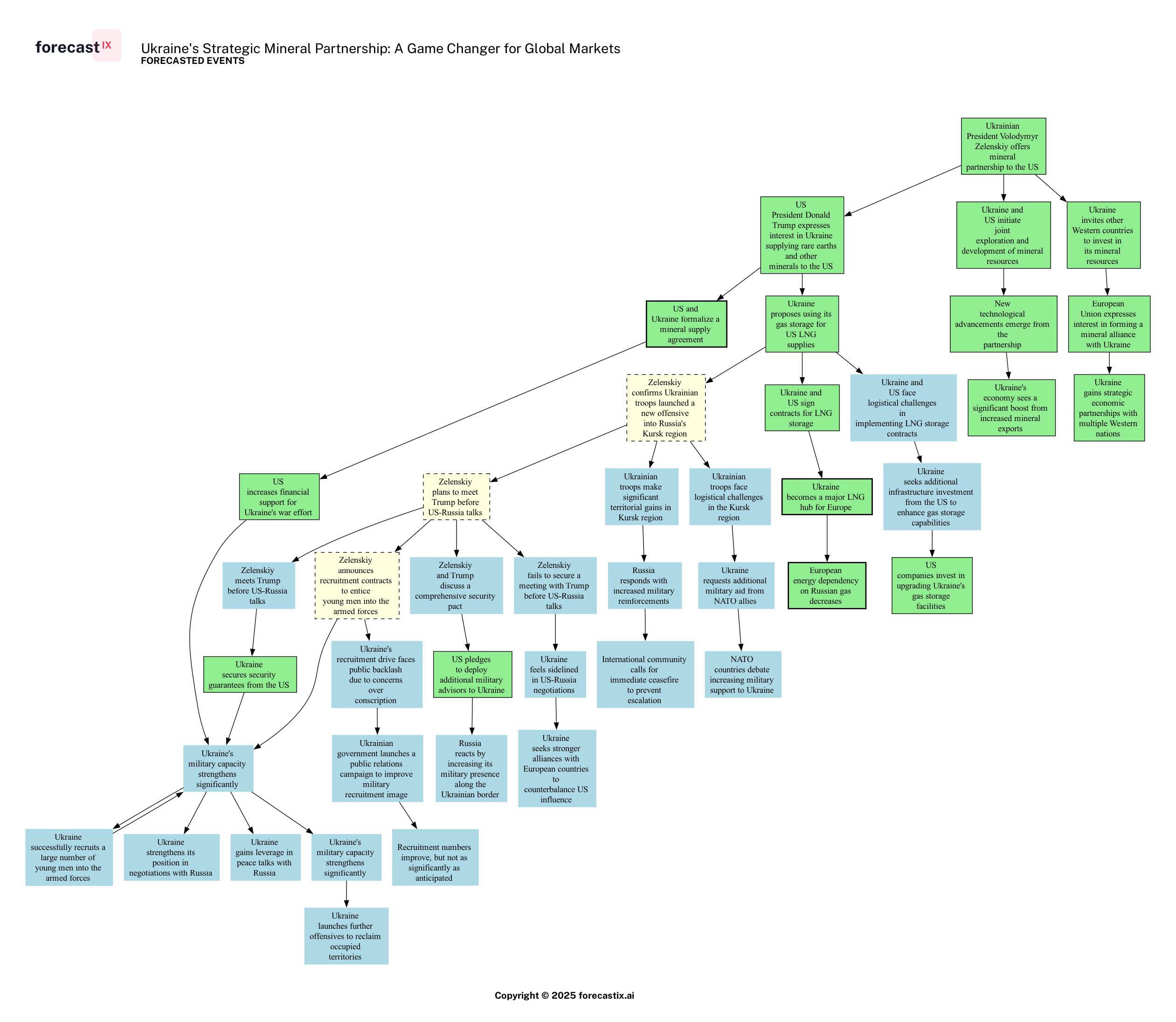

Forecasted chain of events following the Root Events from the base article (yellow). AI-generated.

Forecasted chain of events following the Root Events from the base article (yellow). AI-generated.

As we explore the potential scenarios stemming from President Zelenskiy's strategic propositions, a tapestry of geopolitical and economic possibilities unfolds. A formal mineral supply agreement between the U.S. and Ukraine could significantly bolster Ukraine's economic and strategic standing. This scenario positions Ukraine not just as a recipient of aid but as an active participant in shaping its geopolitical destiny, leveraging its natural resources to secure vital support and influence.

Simultaneously, using Ukraine's gas storage facilities for U.S. LNG supplies could transform Ukraine into a major energy hub for Europe. This shift could decrease Europe's dependency on Russian gas, a strategic move with significant implications for the continent's energy security landscape. The ripple effects could see Ukraine emerging as a key player in the European energy market, attracting further investment and strengthening its economic ties with Western nations.

On the military front, Zelenskiy's plans to recruit more young men into the armed forces highlight a critical need to address manpower shortages. If successful, this recruitment drive could significantly strengthen Ukraine's military capacity, enabling it to launch further offensives to reclaim occupied territories. However, challenges such as potential public backlash and logistical hurdles could necessitate a robust public relations campaign to garner support and improve recruitment numbers.

Moreover, the prospect of Zelenskiy meeting with President Trump before U.S.-Russia talks introduces a layer of diplomatic maneuvering. Securing security guarantees from the U.S. could provide Ukraine with much-needed leverage in peace talks with Russia, potentially altering the dynamics of the ongoing conflict.

In essence, these scenarios reflect a strategic pivot by Ukraine to harness its natural and geopolitical assets, aiming to secure a stronger position on the global stage. Whether through mineral partnerships, energy collaborations, or military enhancements, Ukraine's actions could redefine its role in the region and beyond.

Impact Analysis

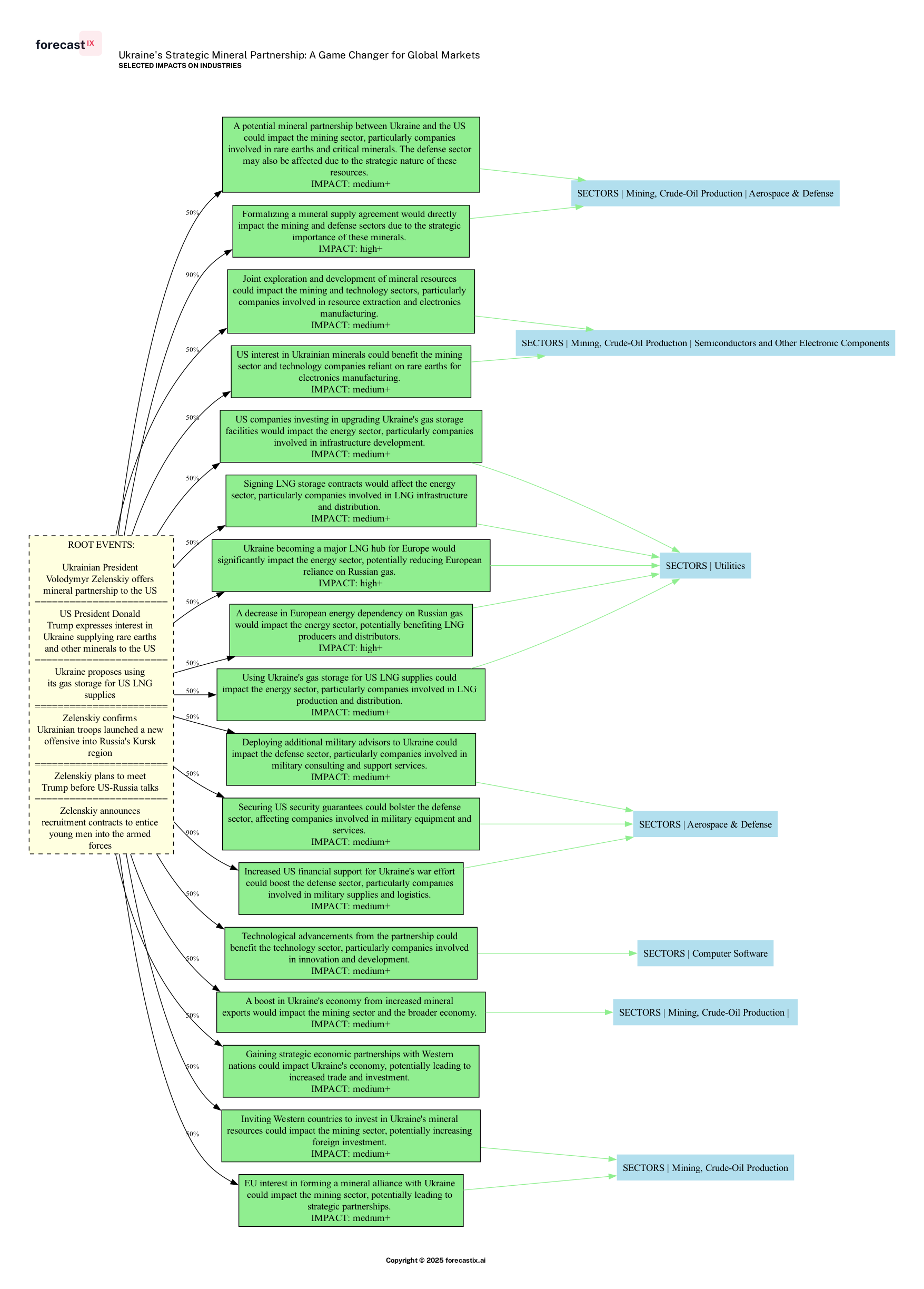

Selected forecasted impacts on industries. Note various likelihood, strength, and direction. AI-generated.

Selected forecasted impacts on industries. Note various likelihood, strength, and direction. AI-generated.

The proposed mineral partnership between Ukraine and the United States is poised to significantly impact the mining and defense sectors. With Ukraine's vast deposits of rare earths and critical minerals, companies like Freeport-McMoRan (FCX) and Newmont Corporation (NEM) could see a surge in activity and investment. This potential agreement could elevate Ukraine as a key supplier of these strategic resources, essential for high-tech manufacturing and defense applications. The aerospace and defense sector, including giants like Lockheed Martin (LMT) and Northrop Grumman (NOC), stands to benefit from increased access to these materials, crucial for producing advanced military technologies.

Moreover, the energy sector could experience a transformative shift as Ukraine positions itself as a major hub for U.S. liquefied natural gas (LNG) supplies to Europe. This move could reduce Europe's reliance on Russian gas, benefiting utility companies such as Exelon (EXC) and Duke Energy (DUK) involved in LNG production and distribution. The strategic use of Ukraine's gas storage facilities could also attract significant infrastructure investments, potentially reshaping the European energy landscape.

In the semiconductor and electronics sectors, companies like NVIDIA (NVDA) and Intel (INTC) could see a positive impact from a steady supply of rare earth elements, vital for manufacturing semiconductors and other electronic components. This partnership might also spur technological advancements, benefiting software giants like Microsoft (MSFT) and Adobe (ADBE), as they leverage new innovations in their products and services.

Overall, the proposed partnership not only promises to bolster Ukraine's economy but also offers substantial opportunities for U.S. companies across multiple sectors, enhancing their competitive edge in the global market.

Investor Takeaways

- Diversification of Investments: Investors should consider diversifying their portfolios by including companies involved in the mining and processing of rare earth elements, such as Freeport-McMoRan and Newmont Corporation, as these companies stand to benefit from the increased demand and strategic importance of these minerals.

- Energy Sector Opportunities: With Ukraine potentially becoming a major hub for U.S. LNG supplies to Europe, energy companies like Exelon and Duke Energy could see increased activity. Investors might explore opportunities within the LNG market and related infrastructure investments.

- Monitoring Geopolitical Developments: The geopolitical landscape is fluid, and investors should closely monitor developments in Ukraine's strategic partnerships and military strategies. These events could have significant implications for global markets, particularly in the defense and technology sectors.

Conclusions

The unfolding partnership between Ukraine and the United States represents a pivotal moment with far-reaching implications for global markets. By leveraging its mineral wealth and strategic geographic position, Ukraine is not only seeking to bolster its economy but also to redefine its geopolitical influence. This chain of events underscores the intricate interplay between natural resources and international relations, offering both risks and opportunities for investors. As Ukraine navigates these complex dynamics, the potential for transformative change in sectors like mining, energy, and technology becomes increasingly apparent. Investors who remain vigilant and adaptable to these shifts will be well-positioned to capitalize on emerging trends.

In conclusion, Ukraine's strategic mineral partnership could indeed be a game changer, reshaping the global market landscape and offering a new narrative of resilience and opportunity. As the world watches these developments unfold, the importance of strategic alliances and resource management in the modern geopolitical arena becomes ever more evident.

"In the world of investing, the greatest opportunities often arise from the most complex challenges."