The USAID Saga: Legal Battles, Global Implications, and Investor Insights

AI-generated based on this event

TL;DR

A U.S. judge has temporarily halted the Trump administration's attempt to dismantle USAID, allowing employees to return to work. This decision has significant implications for global aid, U.S. diplomacy, and international trade.

Introduction

In a surprising turn of events, a U.S. judge has intervened in the Trump administration's controversial plan to dismantle the U.S. Agency for International Development (USAID). USAID has been a cornerstone of U.S. foreign aid, providing critical assistance to developing countries and fostering diplomatic relations. This analysis delves into the legal, diplomatic, and economic ramifications of this decision, offering investors a comprehensive understanding of its potential impacts on global markets and U.S. foreign policy.

Background

In February 2025, the Trump administration sought to pause all U.S. foreign aid, citing unverified claims of corruption within USAID. This move, largely orchestrated by Elon Musk, aimed to reduce federal bureaucracy by placing thousands of employees on leave and relocating humanitarian workers. However, a lawsuit filed by government workers' unions challenged the administration's authority, leading to a judge's temporary halt of the plan. This legal battle underscores the ongoing tension between executive power and legislative oversight in U.S. foreign aid policy.

Scenarios Analysis

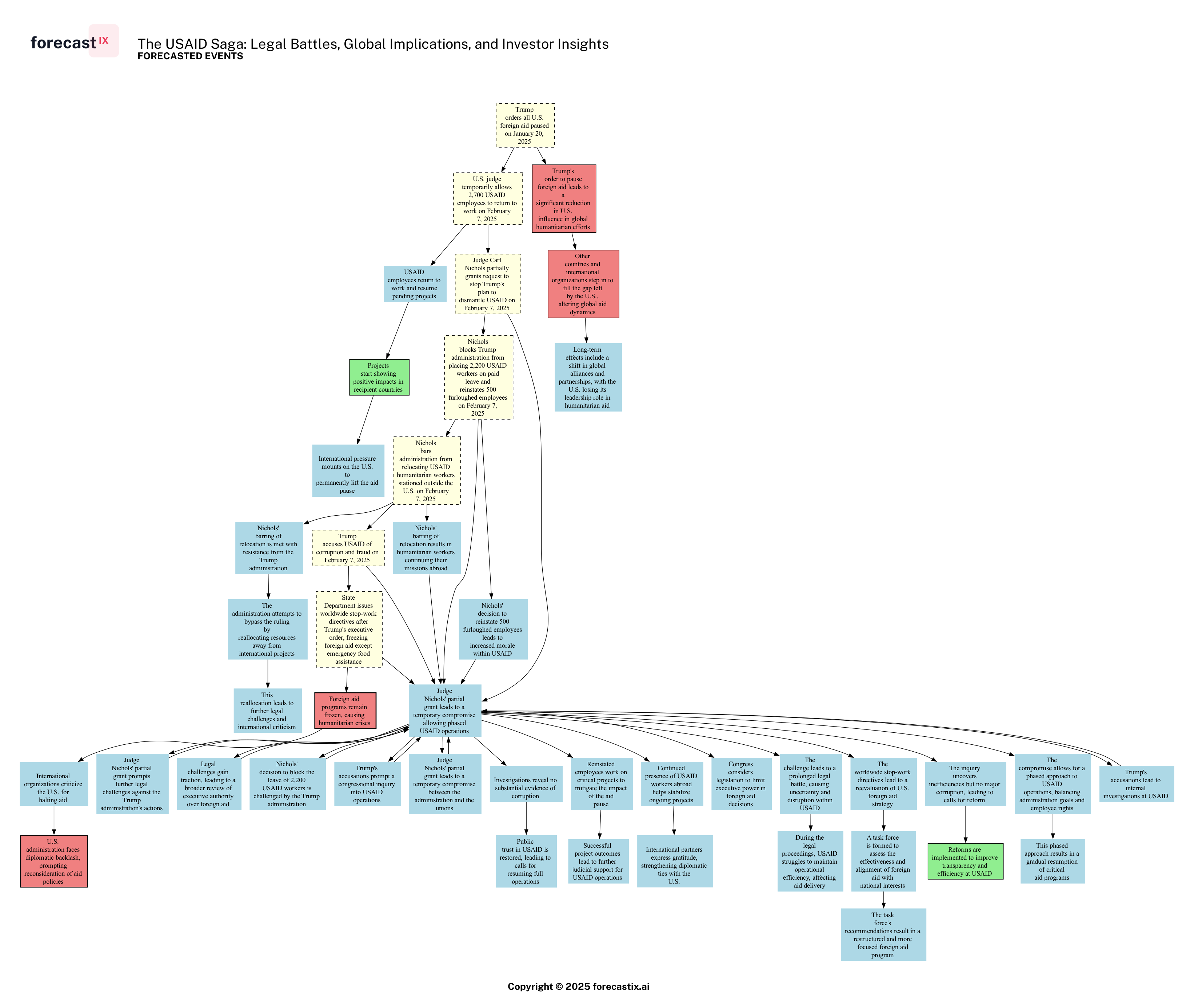

Forecasted chain of events following the Root Events from the base article (yellow). AI-generated.

Forecasted chain of events following the Root Events from the base article (yellow). AI-generated.

The unfolding saga surrounding the U.S. Agency for International Development (USAID) and the Trump administration's attempts to dismantle it has created a complex web of potential outcomes, each with its own implications for international aid and U.S. diplomacy. One of the most intriguing scenarios is the potential restoration of USAID's operations, which could lead to a resurgence of its projects and a ripple effect of positive impacts in recipient countries. This scenario not only highlights the resilience of USAID employees but also underscores the critical role of international pressure in shaping U.S. foreign aid policies. As projects resume and begin to show tangible benefits, the global community may intensify its calls for a permanent lift of the aid pause, potentially forcing the administration to reconsider its stance.

On another front, Trump's accusations of corruption within USAID have sparked internal investigations, which, if they reveal no substantial evidence, could restore public trust and lead to calls for resuming full operations. This scenario reveals a fascinating dynamic where the administration's own actions might inadvertently strengthen USAID's credibility and operational mandate, further complicating the administration's efforts to curtail its influence.

The legal challenges against the Trump administration's actions, prompted by Judge Nichols' partial grant, could also lead to a broader review of executive authority over foreign aid. This could result in Congress considering legislation to limit executive power in foreign aid decisions, a move that might redefine the balance of power between the executive branch and other governmental entities in shaping U.S. foreign policy.

Moreover, the international community's response to the halt in aid, characterized by criticism and diplomatic backlash, could prompt a reevaluation of U.S. foreign aid strategy. This reevaluation might lead to the formation of a task force aimed at aligning foreign aid with national interests more effectively, potentially resulting in a restructured and more focused aid program. Such a shift could alter the global aid dynamics, with other countries and international organizations stepping in to fill the void left by the U.S., thereby reshaping global alliances and partnerships.

In essence, the USAID debacle is not just a domestic issue but a global one, with far-reaching consequences that could redefine the U.S.'s role in international humanitarian efforts. Whether through restored operations, legislative changes, or strategic reevaluations, the outcomes of this situation will likely have lasting impacts on both the U.S. and the global community.

Impact Analysis

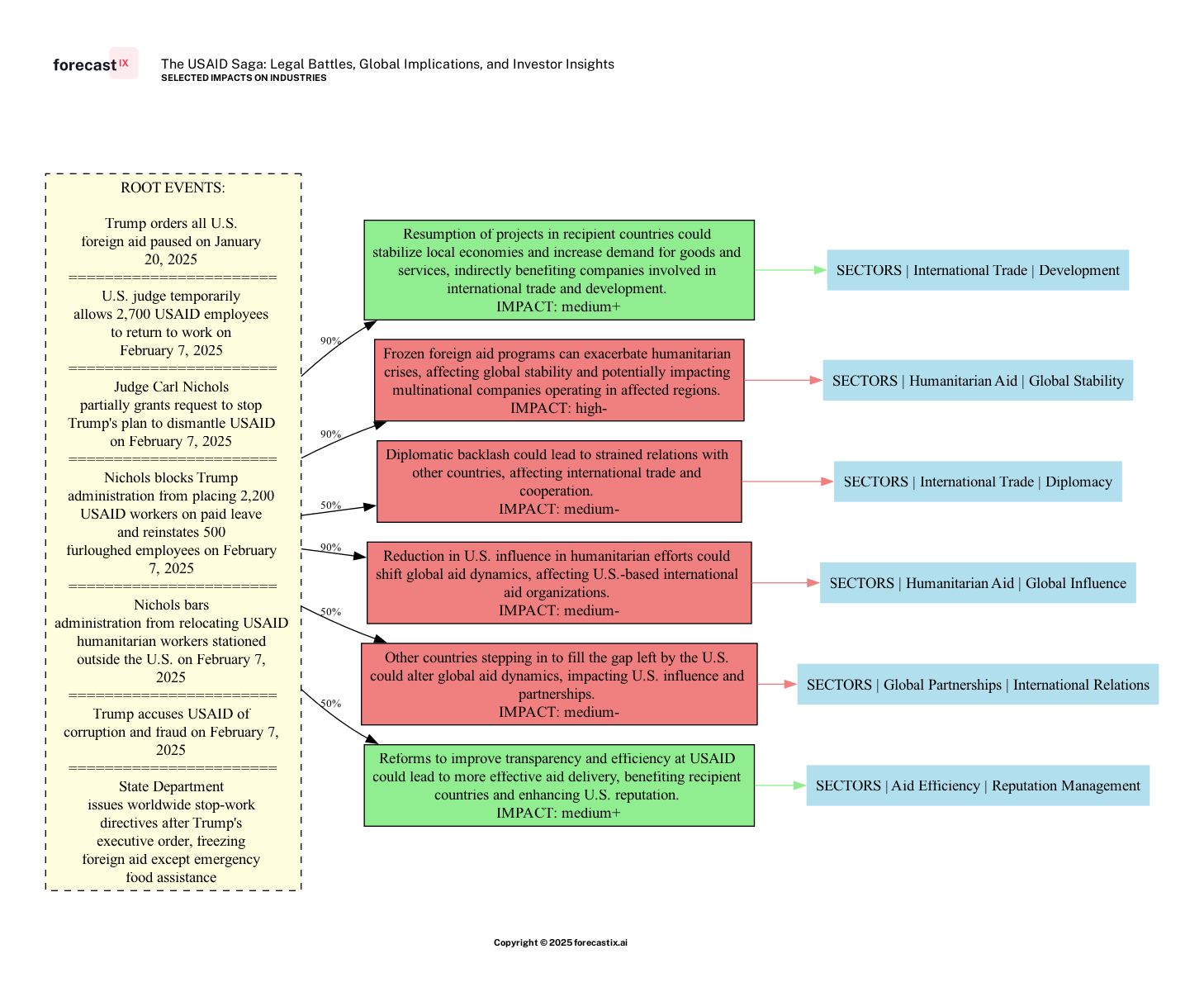

Selected forecasted impacts on industries. Note various likelihood, strength, and direction. AI-generated.

Selected forecasted impacts on industries. Note various likelihood, strength, and direction. AI-generated.

The recent judicial intervention to halt the Trump administration's plan to dismantle USAID has sent ripples through various sectors, with significant implications for both global stability and international trade. The decision to allow USAID employees to return to work temporarily is a pivotal moment, particularly for the humanitarian aid sector, which stands at the brink of exacerbated crises due to the frozen foreign aid programs. This halt could have led to severe destabilization in regions heavily reliant on U.S. aid, potentially impacting multinational companies operating in these areas. The high likelihood of such negative impacts underscores the critical role USAID plays in maintaining global stability.

Moreover, the resumption of USAID's operations could stabilize local economies in recipient countries, indirectly benefiting companies involved in international trade and development. This positive impact, while medium in scale, is highly probable and could lead to increased demand for goods and services, thereby boosting international trade.

However, the diplomatic landscape remains precarious. The initial move to dismantle USAID has already sparked potential diplomatic backlash, which could strain international relations and cooperation. Such tensions could adversely affect international trade, highlighting the interconnected nature of diplomacy and economic activities.

Furthermore, the reduction in U.S. influence in global humanitarian efforts could shift aid dynamics, affecting U.S.-based international aid organizations. As other countries may step in to fill the void left by the U.S., this could lead to altered global partnerships and a diminished U.S. presence in international relations.

On a more optimistic note, the situation presents an opportunity for reforms aimed at improving transparency and efficiency within USAID. Such reforms could enhance the effectiveness of aid delivery, benefiting recipient countries and bolstering the U.S.'s reputation on the global stage. This potential for positive change, although medium in impact, could redefine the narrative surrounding U.S. foreign aid and its role in global development.

Investor Takeaways

- Monitor Legislative Developments: Investors should keep a close eye on any legislative changes that may arise from this legal battle, as they could redefine the balance of power in U.S. foreign aid policy and impact sectors reliant on international aid.

- Assess Global Market Opportunities: With the potential for increased stability in regions benefiting from resumed USAID operations, investors might find new opportunities in emerging markets, particularly in sectors like infrastructure, agriculture, and technology.

- Evaluate Diplomatic Relations: The diplomatic fallout from the USAID saga could affect international trade dynamics. Investors should consider the geopolitical landscape and potential shifts in global alliances when making investment decisions.

Conclusions

The USAID saga is a testament to the intricate interplay between legal frameworks, executive power, and international diplomacy. As the legal proceedings unfold, the potential outcomes could reshape U.S. foreign aid policy and its role in global humanitarian efforts. Investors must remain vigilant, as the ripple effects of these developments could present both risks and opportunities in the global market. The chain of events highlights the importance of understanding the broader implications of policy decisions on international relations and economic stability. Ultimately, the USAID debacle serves as a reminder of the interconnected nature of global markets and the critical role of informed decision-making in navigating complex geopolitical landscapes.

In the words of Warren Buffett, "Risk comes from not knowing what you're doing." As the situation evolves, staying informed will be key to leveraging the opportunities and mitigating the risks that lie ahead.